FAQs

Quote from GLOBAL CA on March 25, 2025, 6:55 amFAQ : When is an audit required for charitable trusts?

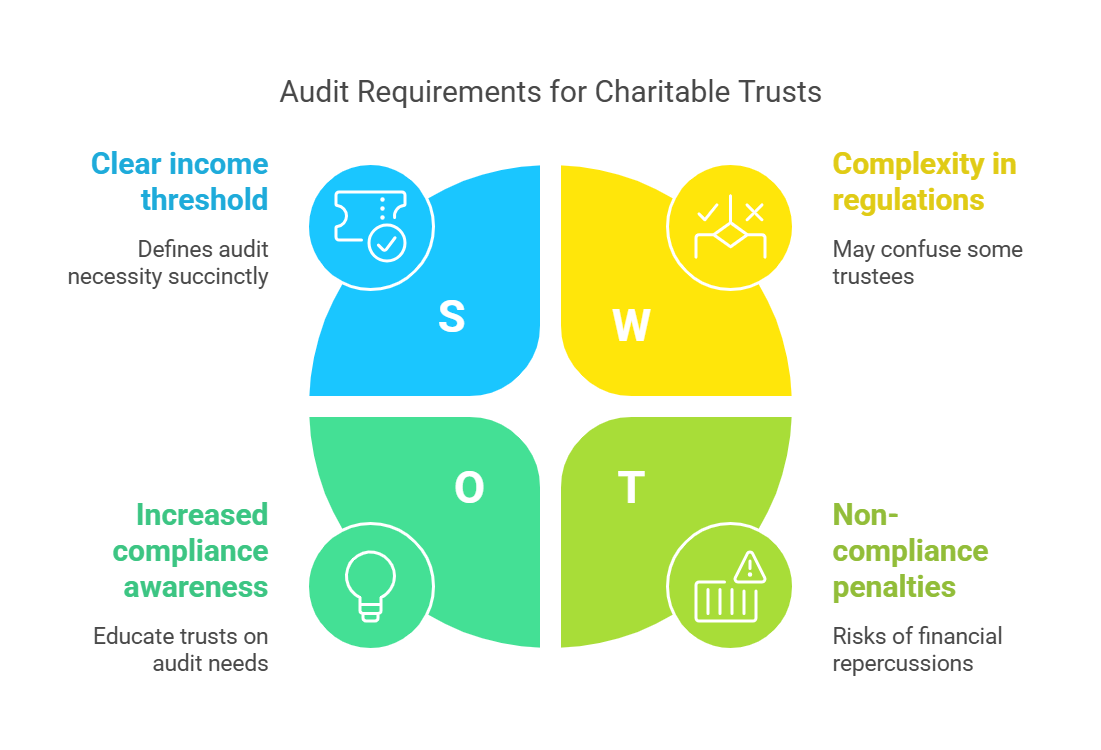

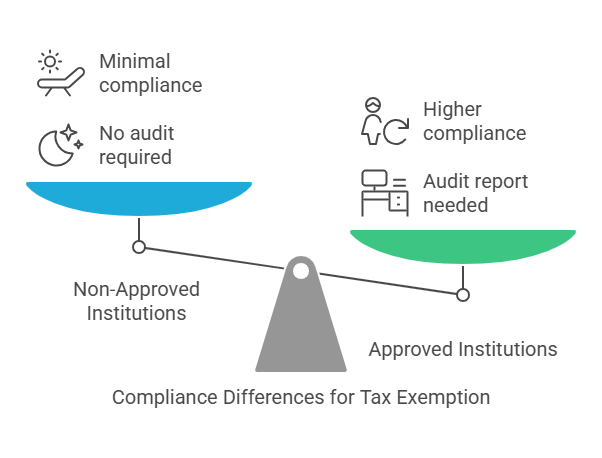

Charitable trusts must specific conditions to qualify for exemptions under Sections 11 and 12, including the mandatory audit of accounts under Section 12A(1)(b). Similarly, institutions approved under Section 10(23C) must have their accounts audited as per its tenth proviso.

An audit is required if the total income of the trust or institution, before claiming exemptions under Section 11, 12, or 10(23C), exceeds the basic exemption limit of ₹2,50,000. However, if the total income remains at or below this threshold, an audit is not mandatory.

FAQ : Is an audit necessary if a trust’s total income is ₹1.50 lakh, but its total application is ₹5.00 lakh?

No, an audit is not required in this case. The audit requirement applies only when the total income, before claiming exemptions under Section 11, 12, or 10(23C), exceeds ₹2,50,000. The amount spent or applied during the year does not determine the necessity of an audit.

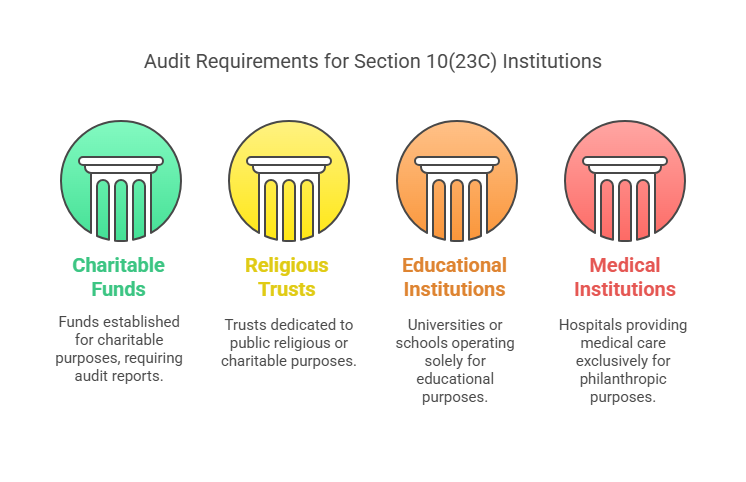

FAQ: Which institutions under Section 10(23C) must submit an audit report in Form 10B/10BB?

Institutions approved by the Principal CIT or CIT under Section 10(23C) are required to file an audit report in Form 10B/10BB if they fall into any of the following categories:

(a) Funds or institutions established for charitable purposes as per Section 10(23C)(iv).

(b) Trusts or institutions dedicated entirely to public religious or charitable purposes under Section 10(23C)(v).

(c) Universities or educational institutions operating solely for educational purposes and not for profit under Section 10(23C)(vi).

(d) Hospitals or similar institutions providing medical care, rehabilitation, or treatment for individuals suffering from illnesses or mental disabilities, operating exclusively for philanthropic purposes and not for profit under Section 10(23C)(via).

FAQ : Do non-approved institutions under Section 10(23C) need to file an audit report in Form 10B/10BB?

Institutions that fall under the non-approval category of Section 10(23C) are eligible for tax exemption on their entire income with minimal compliance requirements. These entities are not subject to the audit report filing requirement. Their only obligation under the Income Tax Act is to submit their income tax return using Form ITR-7.

FAQ : Do organizations registered under Section 12AB and those approved under Section 10(23C) now follow the same audit report format?

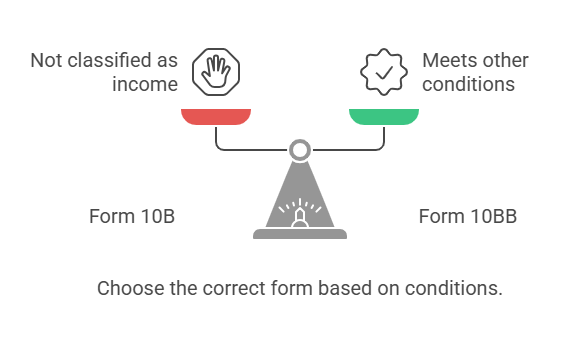

Previously, two distinct audit report formats were used: Form 10B for institutions registered under Section 12AB and Form 10BB for those approved under Section 10(23C).

However, the revised Forms 10B and 10BB now apply to both categories. The selection of the appropriate form depends on specific conditions, such as whether the institution's total income exceeds ₹5 crores, whether it has received foreign contributions, or if it has utilized funds outside India.

It is crucial to note that while both Section 12A-registered trusts and Section 10(23C)-approved institutions must use these updated forms, certain clauses in these forms do not apply to institutions under Section 10(23C). Therefore, auditors must carefully assess whether the entity is registered under Section 12AB or approved under Section 10(23C) before completing Form 10B/10BB. Despite recent amendments, some key differences remain between these two categories.

Key Provisions Exclusive to Section 12AB Registered Trusts (Not Applicable to Section 10(23C) Institutions):

- Modification of Objects: Section 10(23C) institutions do not require re-registration upon modification of their objectives.

- Application of Income Outside India: Unlike Section 11(1)(c), there are no restrictions on applying income outside India.

- Public Benefit Requirement: Section 10(23C) institutions do not face exemption withdrawal or approval cancellation if income is not utilized for public benefit, unlike Section 13(1)(a).

- Restrictions on Religious Community or Caste: Section 10(23C) institutions do not lose exemption if income benefits a specific religious community or caste, unlike Section 13(1)(b).

- Deemed Application of Income: There is no provision for deemed application of income through Form 9A.

- Capital Gains Exemption: Section 10(23C) institutions do not enjoy capital gains exemption under Section 11(1A).

- Business Held Under Trust: Unlike Section 11(4), there is no provision for business income being held under trust.

These differences highlight that while the audit report formats have been aligned, variations in compliance requirements still exist between Section 12AB-registered trusts and Section 10(23C)-approved institutions.

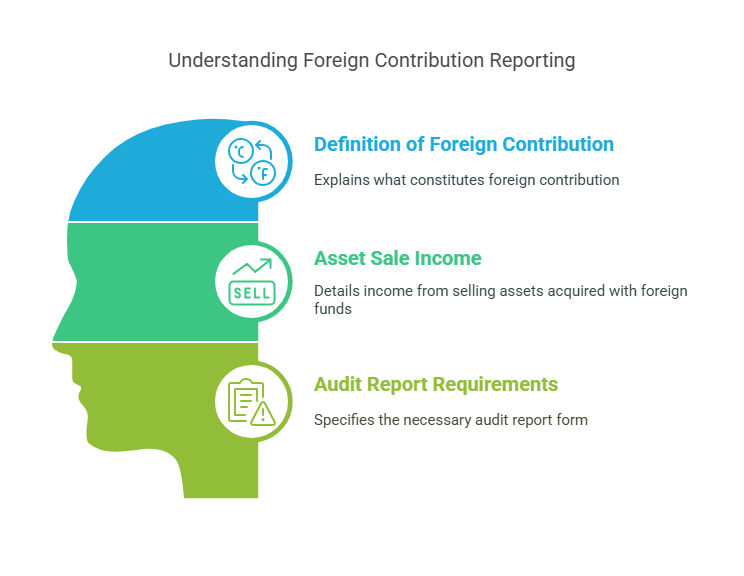

FAQ : What is the definition of "Foreign Contribution" for determining the applicability of Form 10B/10BB submission?

The term "foreign contribution" holds the same meaning as defined under clause (h) of Section 2(1) of the Foreign Contribution (Regulation) Act, 2010 (FCRA, 2010). This includes not only direct foreign contributions but also any income derived from such contributions, such as interest income from investments made using foreign funds and income generated from assets acquired using foreign contributions.

FAQ : If a trust-operated educational institution collects ₹4 crores in total income before availing exemptions under Sections 11, 12, or 10(23C), but does not utilize any of it outside India, should fees collected from foreign students be considered a "foreign contribution" for determining the audit report format?

No, fees collected from foreign students or any payments received for services rendered do not qualify as foreign contributions.

As per Explanation 3 to Section 2(1)(h) of FCRA, 2010, any amount received from a foreign source as fees charged by an educational institution in India or as contributions from a foreign source’s agent specifically toward such fees is excluded from the definition of "foreign contribution."

Therefore, even if the trust collects fees from foreign students during the relevant financial year, this will not be classified as receiving a foreign contribution for audit reporting purposes.

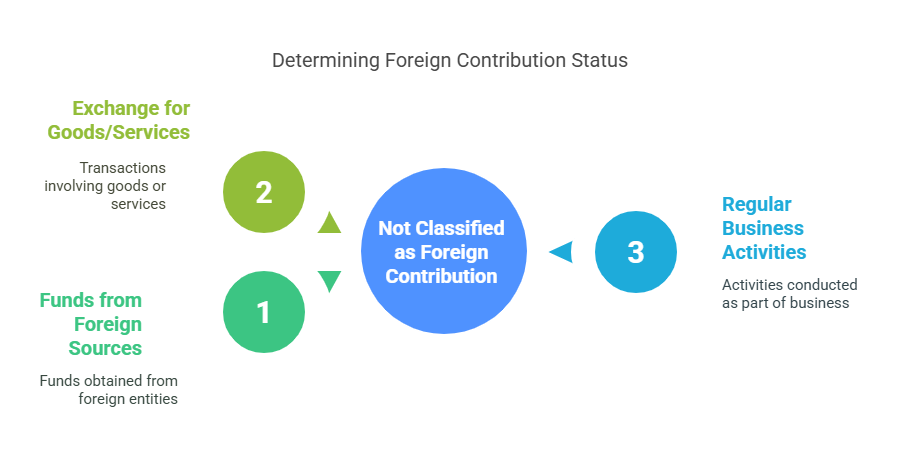

FAQ : Does a trust receive "foreign contributions" when it obtains funds from foreign sources in exchange for goods or services provided as part of its regular business activities?

No, it does not.

As per Explanation 3 to Section 2(1)(h) of FCRA, 2010, any payment received from a foreign source in exchange for goods or services rendered as part of regular business, trade, or commercial activities—whether conducted within India or internationally—does not qualify as a foreign contribution. Additionally, any amount received from a foreign source’s agent to cover such fees or costs is also excluded from the definition of foreign contributions.

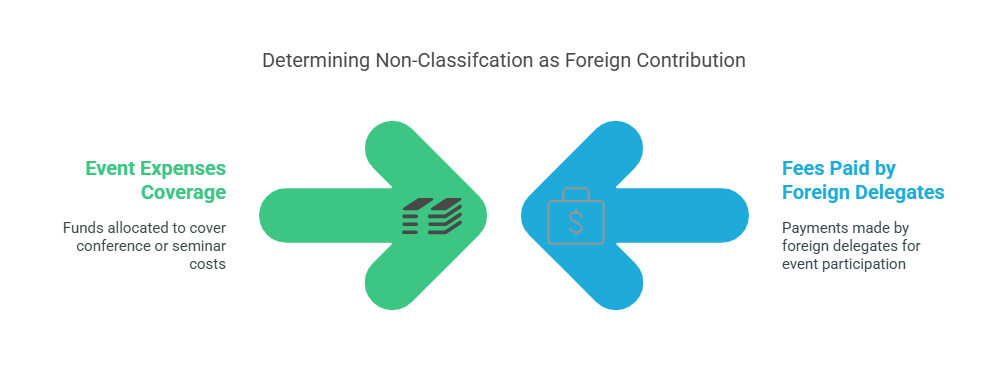

FAQ : Is the fee paid by foreign delegates or participants for attending conferences, seminars, etc., classified as a foreign contribution?

No, it is not.

As clarified in FAQ No. 12 of the FAQs on FCRA (available at https://fcraonline.nic.in), fees paid by foreign delegates or participants to attend conferences or seminars are not considered foreign contributions. These amounts are specifically intended to cover the event's expenses and are therefore excluded from the scope of foreign contributions under FCRA, 2010.

FAQ : If a trust registered under FCRA has not received any foreign contributions during the current financial year but has earned income from the sale of assets acquired using foreign contributions, does this income qualify as a foreign contribution? Which audit report form should be used?

Yes, income generated from the sale of assets originally acquired using foreign contributions is considered a foreign contribution.

As per Item 2 of Form FC-4 under FCRA, 2010, foreign contributions for the year include not only direct receipts but also interest earned on foreign contributions and any income derived from assets created using foreign funds—such as proceeds from their sale.

In such cases, the trust must submit an audit report in Form 10B to comply with the reporting requirements.

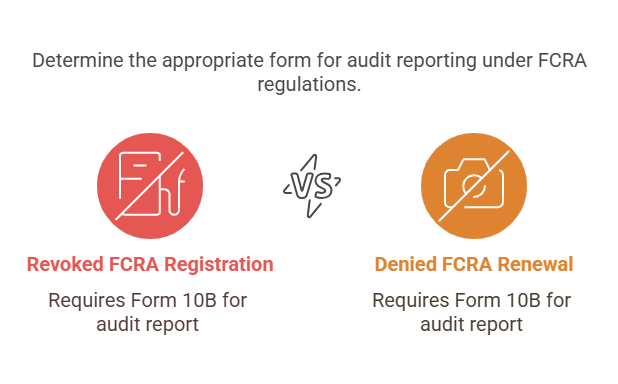

FAQ : If an NGO’s FCRA registration has been revoked or its renewal denied, but it continues to earn interest on foreign assets, which form should be used for the audit report?

Even after an NGO's FCRA registration has been cancelled, any interest earned on its foreign assets remains classified as a foreign contribution under FCRA, 2010.

Thus, the NGO must file an audit report using Form 10B.

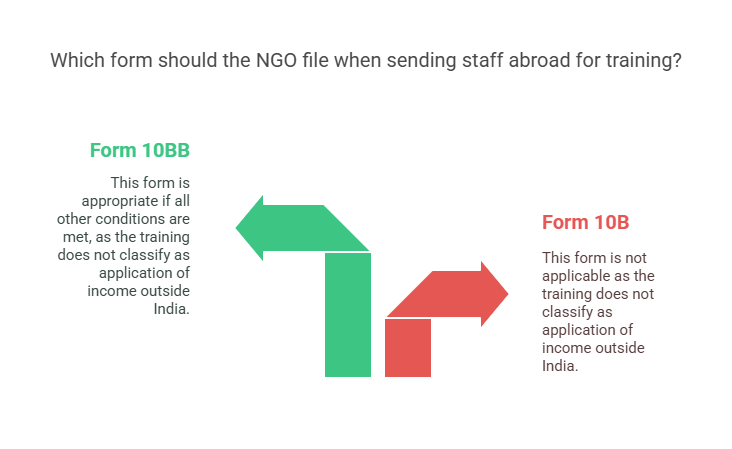

FAQ : If an NGO sends its staff abroad for training, should it file Form 10B or Form 10BB?

Sending NGO employees abroad for training purposes does not automatically classify as an application of income outside India under Section 11(1)(c).

If all other conditions for Form 10BB are met, the NGO should file Form 10BB instead of Form 10B.

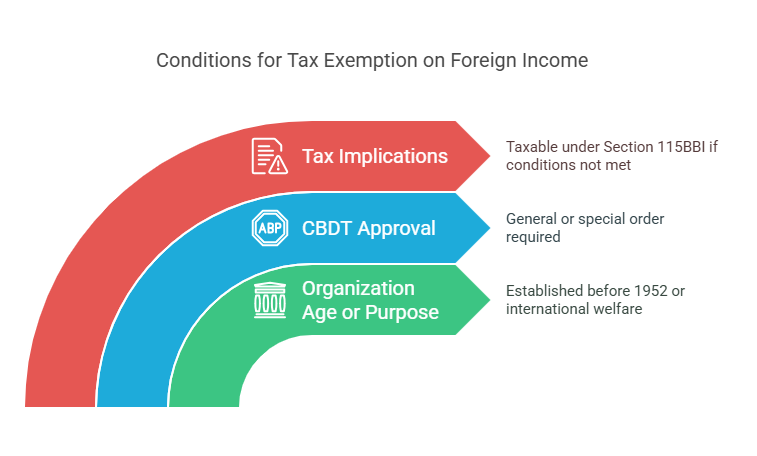

FAQ : What qualifies as "application of income outside India" for filing an audit report in Form 10B?

According to Section 11(1)(c) of the Income Tax Act, income spent on activities outside India does not qualify for exemption unless the following conditions are met:

(a) The charitable organization was established before April 1, 1952, or is engaged in the promotion of international welfare in which India has an interest.

(b) The CBDT (Central Board of Direct Taxes) has granted approval through a general or special order for such activities.

Organizations seeking approval for carrying out charitable activities abroad must submit their applications to Member (IT), CBDT, Department of Revenue, Ministry of Finance, North Block, New Delhi.

If the above conditions are not fulfilled, income spent on activities outside India will be taxable under Section 115BBI.

FAQ : If an NGO sends its staff abroad for training, should it file Form 10B or Form 10BB?

Sending NGO employees abroad for training purposes does not automatically classify as an application of income outside India under Section 11(1)(c).

If all other conditions for Form 10BB are met, the NGO should file Form 10BB instead of Form 10B.

FAQ : Are corpus donations and capital gains included in calculating the ₹5 crore threshold for filing Form 10B?

Yes.

The obligation to file Form 10B arises when the total income of a charitable institution—calculated without considering exemptions under Sections 11 and 12—exceeds ₹5 crore.

Since corpus donations and capital gains receive exemptions under Section 11, these amounts must be included when determining whether the ₹5 crore threshold has been exceeded.

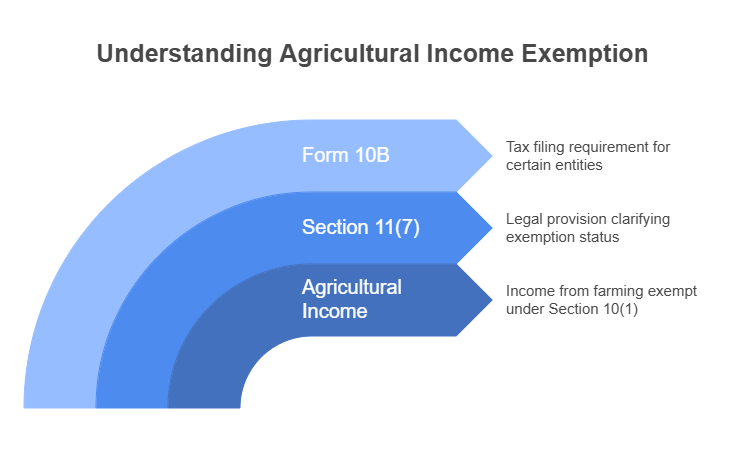

FAQ: Should agricultural income, exempt under Section 10(1), be included when calculating the ₹5 crore threshold for filing Form 10B?

No.

As per Section 11(7) of the Income Tax Act, agricultural income is not subject to the conditions of exemption under Sections 11 and 12.

Therefore, agricultural income does not need to be added when calculating the ₹5 crore limit for determining the applicability of Form 10B.

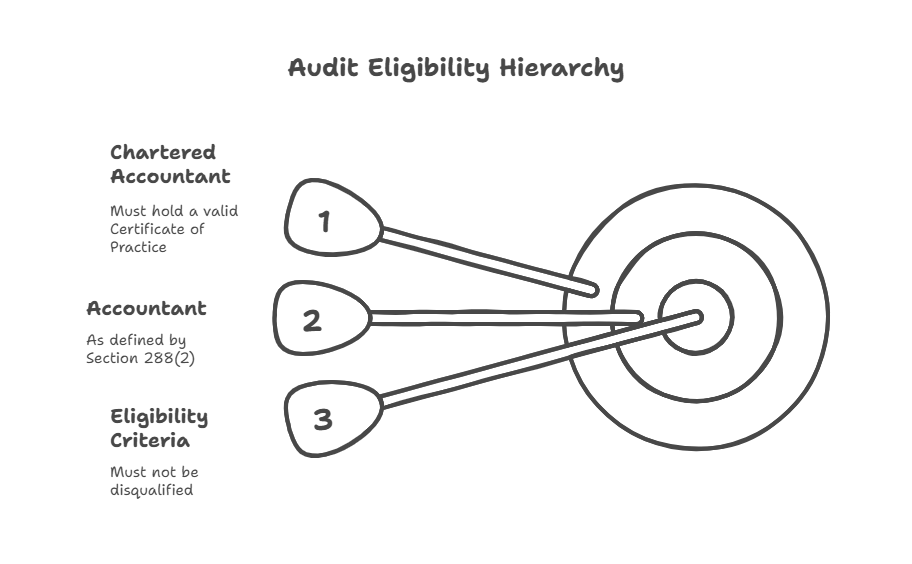

FAQ : Who is eligible to audit the accounts of a trust or institution?

The audit must be conducted by an accountant as defined under the Explanation to Section 288(2) of the Income Tax Act.

According to this provision, a Chartered Accountant (CA) holding a valid Certificate of Practice is eligible to undertake the audit. However, the CA must not be disqualified under clauses (a) and (b) of the Explanation to Section 288(2).

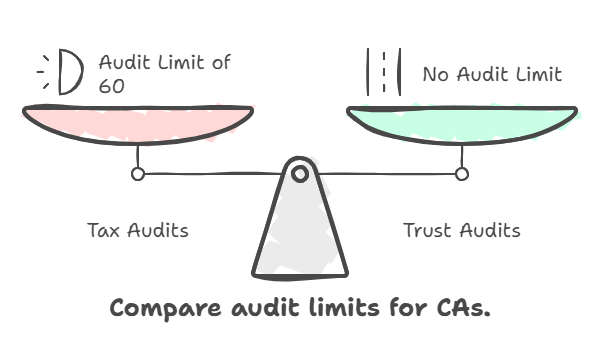

FAQ : Is there a limit on the number of audit assignments a Chartered Accountant can undertake for trusts and institutions under Section 12A or Section 10(23C)?

No, there is no such limit.

The Council Guidelines of 2008 under Chapter IX specify a limit of 60 tax audits under Section 44AB of the Income Tax Act. However, this limit applies only to tax audits under Section 44AB and does not apply to audits of trusts and institutions under Section 12A or Section 10(23C).

Therefore, a Chartered Accountant can undertake multiple audits of trusts and institutions without any upper limit.

FAQ : Can an auditor comment on the application of funds solely based on the Income and Expenditure Account in Form 10B and Form 10BB?

The audit reports in Form 10B and Form 10BB require the auditor to express an opinion on whether the Income and Expenditure Account (or Profit and Loss Account) gives a true and fair view of the income, application of funds, profit, or loss, considering any observations or qualifications.

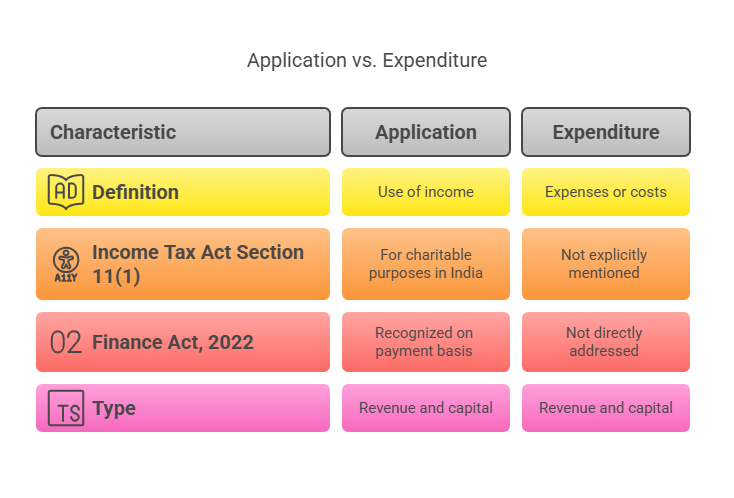

Understanding the Concept of "Application" of Income:

- The term “Application” in this context is not the same as "Expenditure."

- Section 11(1) of the Income Tax Act states that income derived from property held under trust for charitable and religious purposes or receipts from voluntary contributions is exempt if applied for charitable purposes in India.

- The Finance Act, 2022 introduced an Explanation to Section 11(7), which states that application of income is recognized only on a payment basis, meaning expenses are considered "applied" only in the year they are actually paid, not when they are incurred.

- Both revenue and capital expenditures for charitable purposes are considered as an application of income.

Challenges in Determining Application Solely from the Income & Expenditure Account:

- The Income and Expenditure Account is traditionally prepared using accrual accounting, whereas the Income Tax Act requires application to be determined on a payment basis.

- Application from corpus, loans, and borrowings is now restricted.

- Past deficits cannot be set off against the current year's income when computing the 85% application requirement.

- Payments without TDS compliance are reduced by 30%, and payments exceeding ₹10,000 in cash are disallowed from the eligible application calculation.

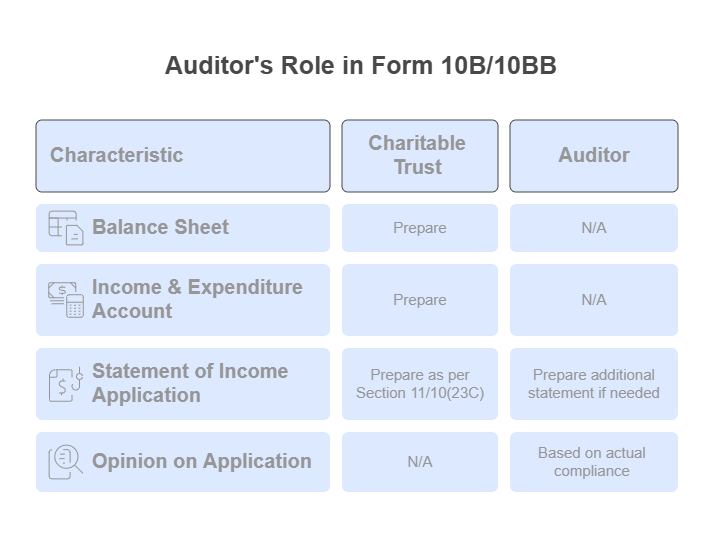

Auditor’s Role and Recommended Approach:

To provide an opinion in Form 10B/10BB, a charitable trust must prepare its:

- Balance Sheet

- Income and Expenditure Account

- Statement of Application of Income (computed as per Section 11 or 10(23C)).

If the Income and Expenditure Account is not strictly prepared as per Section 11, the auditor should prepare an additional statement reconciling the computation of income and application as per the Income Tax Act. This additional statement should be annexed to the financial statements to ensure compliance.

This approach ensures that the auditor’s opinion on application is based on actual compliance with the Income Tax provisions rather than conventional accounting methods.

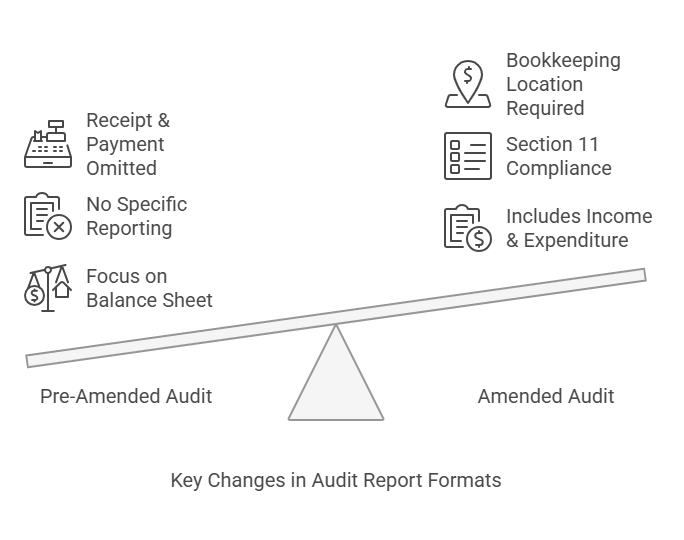

FAQ : Key Differences in the Amended Audit Report Format Compared to the Pre-Amended Version ?

In the pre-amended format, the auditor's examination was primarily focused on the Balance Sheet and Profit & Loss Account. However, under the amended format, auditors are now required to certify the Balance Sheet, Income & Expenditure Account, or Profit & Loss Account.

Notable Changes:

- Inclusion of "Income & Expenditure Account"

- This is significant in the context of charitable institutions, ensuring income and application are reported in accordance with Section 11.

- The Income & Expenditure Account must be prepared strictly as per the provisions of Section 11, meaning:

- Income should be recognized as per Section 11.

- All permissible applications, including capital expenditure and inter-charity grants, should be shown on the expenditure side.

- Receipt & Payment Account Not Explicitly Included

- Although a major portion of income and expenditure is on a cash basis, the Receipt & Payment Account is not explicitly labeled as one of the financial statements in the audit report.

- New Requirement to Report the Place of Bookkeeping

- The auditor is now required to provide details about where the books of accounts are maintained.

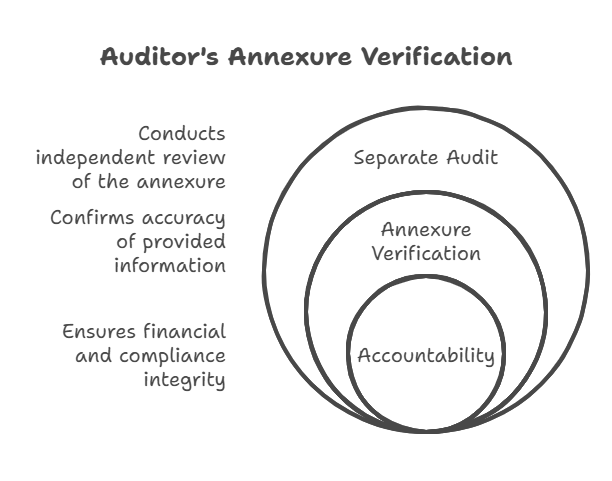

FAQ : Key Changes in Auditor's Responsibility for Annexure in Form 10B/10BB ?

- Previously, in the pre-amended format, there was no separate requirement for certification of the Annexure to Form 10B/10BB.

- The audit report only mentioned that “the prescribed particulars are annexed hereto.”

Changes in the Amended Format:

- The auditor must now audit the annexure separately and certify that the information provided is true and correct.

- This increases accountability and ensures that financial and compliance details in the annexure are verified.

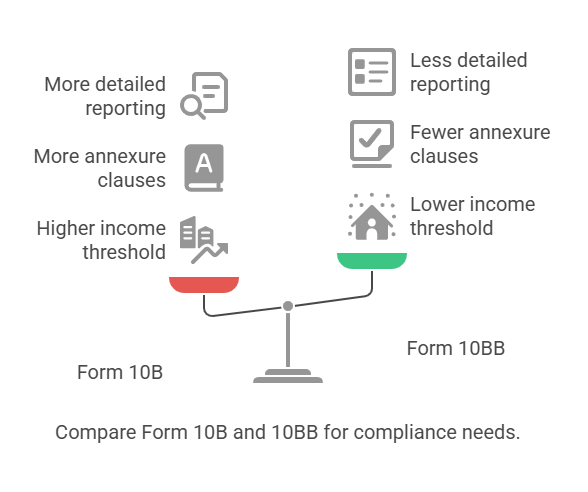

FAQ : Key Differences Between Form 10B and Form 10BB ?

- Form 10B requires more detailed reporting compared to Form 10BB.

Form 10B (Not in Form 10BB FAQ):

- Registration Details (Clause 9)

- Objectives of the Trust (Clauses 11-12)

- Advancement of General Public Utility (Clauses 15-16)

- Business Undertaking (Clause 17)

- Business Incidental to Objectives (Clause 18)

- TDS on Receipts (Clause 19)

- Applicability of Section 10(23C) and Section 13(10) (Clause 20)

- Other Income (Clause 35)

- Capital Asset Transactions (Clause 36)

- High-Value Payments (>₹50 Lakhs to a Single Person) (Clause 38)

- Religious Expenditure (Clause 40)

- Claiming Exemptions Under Other Sections of 10 (Clause 45)

- Loans & Deposits Above Limits of Section 269SS (Clause 46)

- Receipts Above Limits of Section 269ST (Clause 47)

- Repayment of Loans & Deposits Above Limits of Section 269T (Clause 48)

Summary of Key Differences Between Form 10B & 10BB

Aspect Form 10B Form 10BB Applicability Charitable institutions above ₹5 crore income Charitable institutions below ₹5 crore income Annexure Clauses 49 clauses 32 clauses Level of Detail More extensive, includes business undertakings, high-value transactions, and loan compliance Less detailed TDS Reporting Mandatory Not required High-Value Transactions (>₹50L) Reporting Mandatory Not required Business Undertakings & Incidental Business Included Not included Religious Expenditure Reporting Included Not included These changes emphasize greater compliance, financial transparency, and stricter audit accountability under the new format.

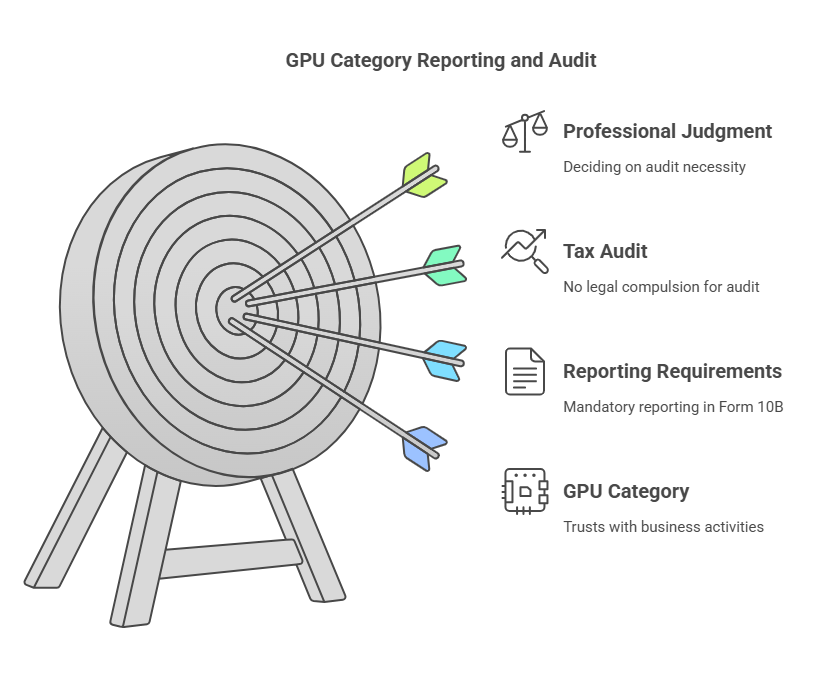

FAQ : Are GPU Category Trusts Engaged in Business Activities Required to Undergo a Tax Audit in Form 3CA/3CB-3CD for Their Business Income?

Understanding the Applicability of Section 11(4A):

- Trusts categorized under the General Public Utility (GPU) category conducting business-like activities fall under Section 11(4A) of the Income Tax Act.

- Point 9 of the Notes to Form 10B states that if a trust has business income, it must upload the Balance Sheet, Profit & Loss Account, and Audit Report in Form 3CA or 3CB.

Lack of Legal Mandate for Tax Audit in Form 3CA/3CB-3CD:

- There is no explicit statutory provision under the Income Tax Act requiring a tax audit under Form 3CA/3CB-3CD for trusts falling under Section 11(4A).

- Point 9 of Form 10B does not hold the same authority as the law itself, meaning it cannot override the provisions of the Income Tax Act.

Conclusion:

- GPU category trusts with business activities fall under Section 11(4A) and are subject to reporting requirements in Form 10B.

- However, there is no legal compulsion to undergo a tax audit in Form 3CA/3CB-3CD, despite what is mentioned in Form 10B's notes.

- Professional judgment should be exercised before deciding on the audit requirement.

FAQ : What is the Deadline for Submitting the Audit Report in Form 3CA/3CB-3CD for Business Income Under Section 11(4) or Section 11(4A) for FY 2022-23?

If an NGO opts to file a Tax Audit Report using Form 3CA/3CB-3CD for its business activities under Section 11(4) or Section 11(4A), it must comply with the due dates prescribed under Section 44AB of the Income Tax Act.

- As per Section 44AB, the tax audit report must be submitted one month before the deadline for filing the income tax return under Section 139(1).

- For FY 2022-23, the original deadline for the tax audit report was 30th September 2023.

- However, since the ITR filing deadline for audited NGOs was extended to 30th November 2023, the corresponding tax audit report deadline was extended to 31st October 2023.

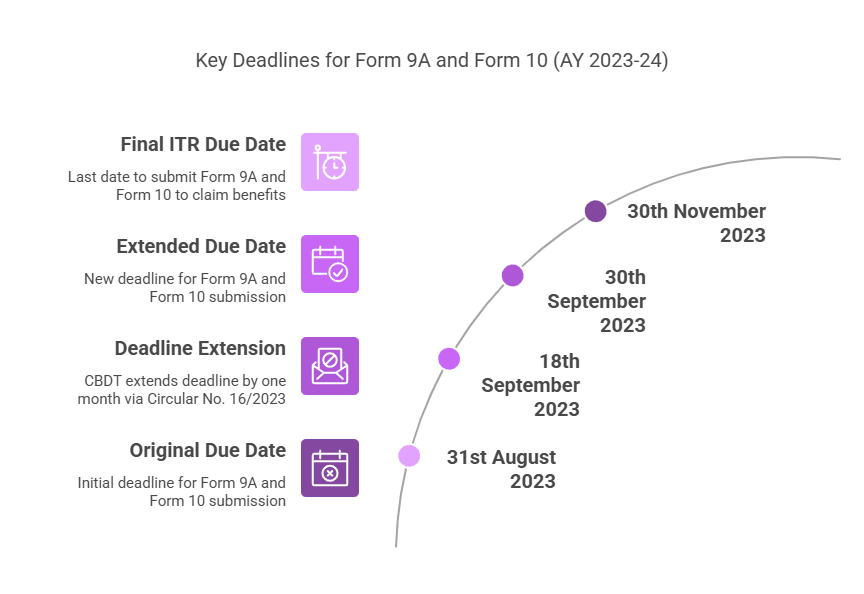

FAQ : What are the Deadlines for Filing Form 9A and Form 10? Is It Mandatory to Submit These Forms Before Filing Form 10B/10BB?

- The due date for Form 9A and Form 10 for AY 2023-24 was originally 31st August 2023.

- Vide Circular No. 16/2023 (dated 18-09-2023), the deadline was extended by one month, allowing submission until 30th September 2023.

- However, the CBDT clarified that the benefit of deemed application or accumulation will not be denied to a trust even if Form 9A and Form 10 are not filed at least two months before the ITR deadline under Section 139(1).

- Nevertheless, Form 9A and Form 10 must be submitted before the final ITR due date (30th November 2023) to claim this benefit.

Should Form 9A and Form 10 Be Filed Before the Audit in Form 10B/10BB?

- While there is no mandatory requirement to submit Form 9A and Form 10 before filing the audit report, auditors must consider the deemed application and accumulation amounts while finalizing the audit.

- Practical Recommendation: To avoid discrepancies, it is advisable to submit Form 9A and Form 10 before the audit report in Form 10B/10BB is finalized.

FAQ : Where to Upload the Balance Sheet, Income & Expenditure or Profit & Loss Statement, and Tax Audit Report in the New Form 10B/10BB?

In the new Form 10B/10BB, certain attachments are mandatory under the "Attachments" panel, while others are optional:

Mandatory Attachments:

- Income & Expenditure Account / Profit & Loss Account

- Balance Sheet

Optional Attachment:

- A "Miscellaneous Attachments" option is available for attaching any other relevant documents.

File Format and Size Restrictions:

- Each attachment must be in PDF or ZIP format.

- If a ZIP file is used, it should only contain PDFs inside.

- Maximum file size per attachment: 5MB.

FAQ : Can the Filed Form 10B/10BB Be Revised?

Yes, the e-filing portal allows for revision of Form 10B/10BB under certain circumstances.

When Can the Audit Report Be Revised?

A Chartered Accountant (CA) should not revise the audit report in normal cases, but revision may be necessary in the following situations:

- Revision of Financial Statements

- If the accounts are revised after adoption in the AGM, the audit report may need modification.

- Change in Law

- A retrospective amendment in the Income Tax Act may necessitate a revision.

- Change in Interpretation

- If a CBDT Circular, Court Judgment, or Tribunal Ruling impacts the financial statements, a revision may be required.

Thus, while revision is generally not allowed, it is possible under specific legal and accounting circumstances

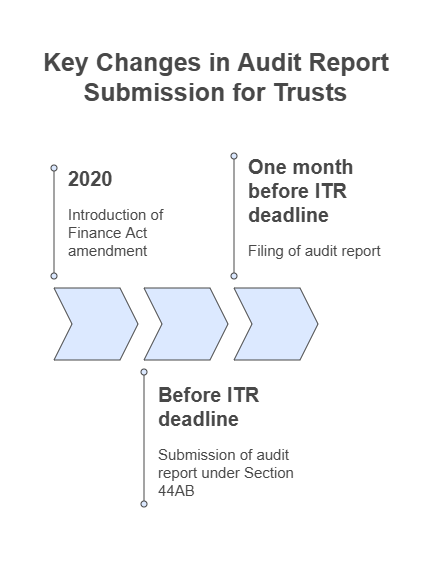

FAQ : Is the Submission of the Audit Report Mandatory or Optional?

The Finance Act, 2020, introduced an amendment to Section 12A(1)(b), making it compulsory for trusts and institutions to obtain and submit the audit report within the prescribed timeline.

Key Changes:

- Previously, submitting the audit report was optional (directory in nature).

- Now, trusts and institutions must get their accounts audited before the due date specified in Section 44AB and submit the audit report within that timeframe.

- As per Section 44AB, the audit report must be filed one month before the deadline for filing the Income Tax Return (ITR) under Section 139(1).

Consequences of Non-Compliance:

- If the audit report is not submitted on time, the trust loses its exemption benefits.

- The trust’s income will then be taxed under Section 13(10) and Section 13(11), applicable from AY 2023-24.

Thus, filing the audit report is now mandatory, and failure to comply can lead to taxation of the trust's income instead of exemption.

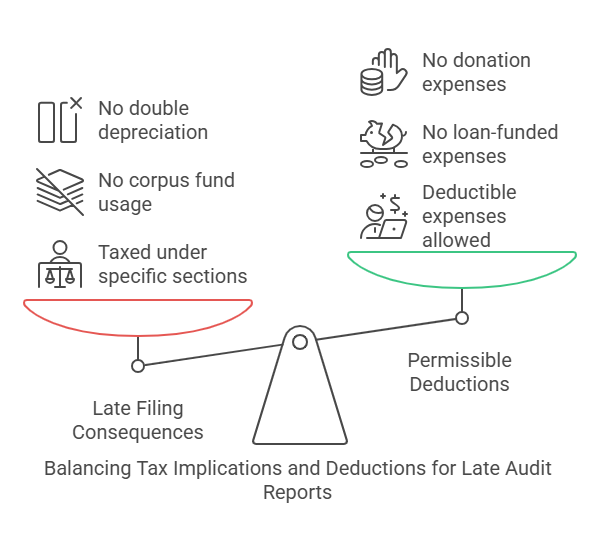

FAQ : How Is Income Taxed If the Audit Report Is Filed Late?

If a trust or institution fails to submit the audit report within the prescribed time, its income will be taxed under Section 13(10), Section 13(11), and the 22nd proviso to Section 10(23C), effective from AY 2023-24.

Permissible Deductions Despite Late Filing:

Even if the audit report is delayed, certain expenses may still be deducted, provided they meet the following conditions:

- Not Utilized from Corpus Funds:

- The expenses should not be funded from the corpus available at the end of the previous financial year.

- Not Financed by Loans or Borrowings:

- The expenses should not be covered using borrowed money.

- No Double Benefit on Depreciation:

- If an asset’s cost has already been claimed as an application of income, then depreciation on that asset cannot be claimed again.

- Not in the Form of Donations or Contributions:

- The expenses should not be in the form of donations made to any other person or entity.

Impact of Late Filing:

- If the audit report is submitted after the deadline, these restrictions will apply when computing taxable income.

- The trust will not be eligible for tax exemption under Sections 11 and 12 for that assessment year.

Conclusion:

To retain exemption benefits, trusts and institutions must submit their audit reports on time. A delayed submission will lead to income taxation with only limited deductions permitted.

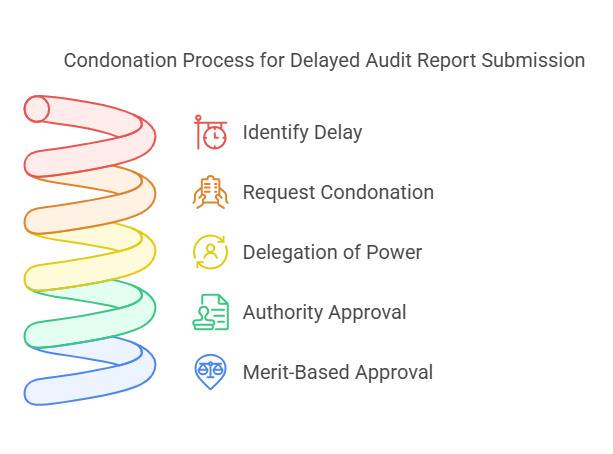

FAQ : Can a Delay in Filing the Audit Report Be Condoned?

If the audit report is not submitted on time, the assessee can request a condonation of delay under Section 119(2)(b) by approaching the jurisdictional Commissioner of Income Tax (Exemptions) [CIT(E)].

Condonation Process:

- Delegation of Power: The Central Board of Direct Taxes (CBDT) has issued circulars allowing for condonation of delays in filing Form 10B and Form 10BB if the entity submits an application to the relevant authority.

- Authority to Grant Condonation:

- Delays up to 365 days → Can be approved by the CIT (E).

- Delays exceeding 365 days → Require approval from the Principal Chief Commissioner of Income Tax (PCCIT) or Chief Commissioner of Income Tax (CCIT).

- Merit-Based Approval:

- Condonation is granted only if the assessee demonstrates a valid and reasonable cause for missing the deadline.

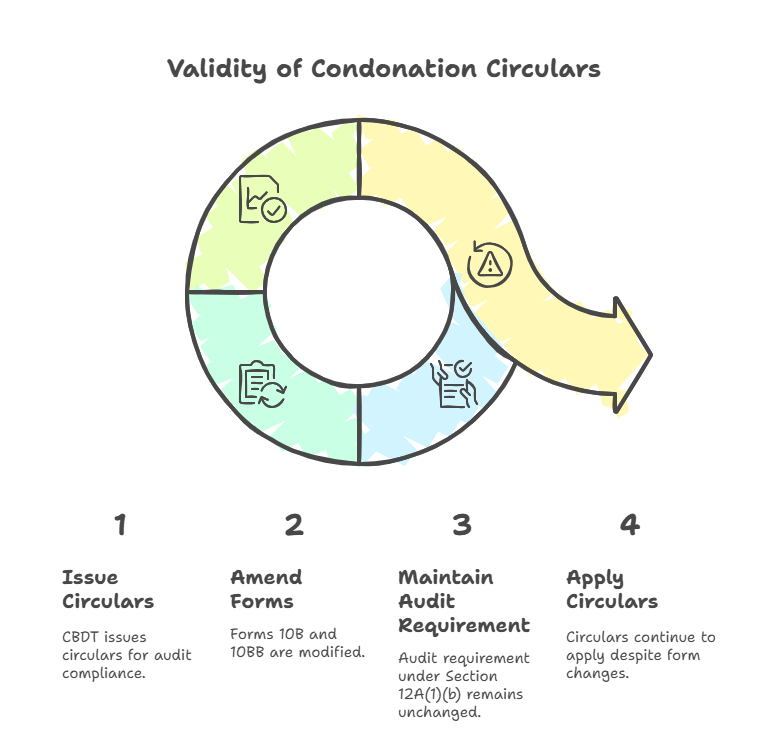

FAQ : Do Condonation Circulars Remain Valid After Changes in Forms 10B and 10BB?

Yes, the CBDT Circulars remain effective even after the amendments in Forms 10B and 10BB.

Key Reasons:

- The circulars were issued specifically for audit compliance under Section 12A(1)(b).

- Since the audit requirement under Section 12A(1)(b) remains unchanged, these circulars continue to apply.

Thus, even after the modifications in Forms 10B and 10BB, the condonation process remains applicable.

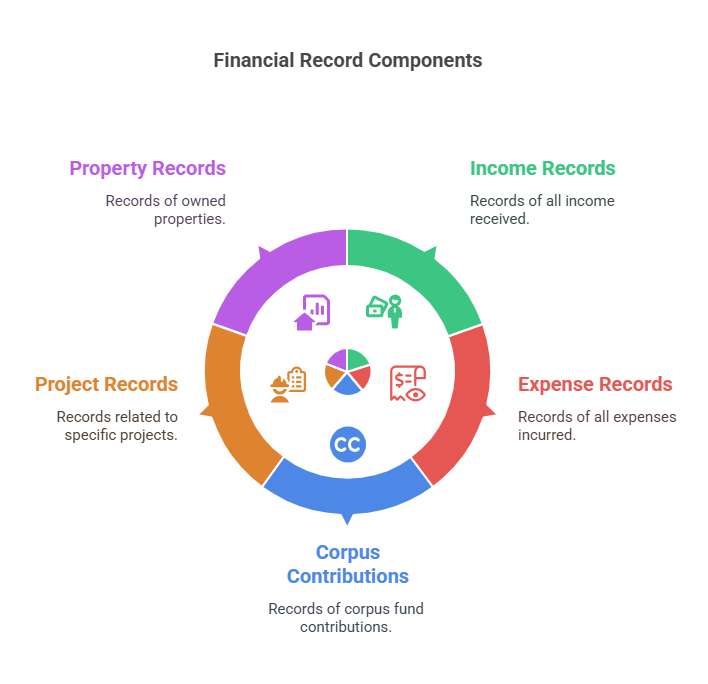

FAQ : Nature of Books of Account and Documents Required Under Rule 17AA

Clause 14 of Form 10B and Clause 11 of Form 10BB require the auditor to confirm whether the auditee has maintained books of account and documents in accordance with Rule 17AA.

Books and Documents Required to Be Maintained Under Rule 17AA:

Entities approved under section 10(23C) or registered under section 12AB must maintain the following:

(a) Books of Account [Rule 17AA(1)(a), (b) & (c)]

- Cash Book

- Ledger

- Journal

- Copies of bills (machine-numbered or serially numbered, if issued by the entity)

- Receipts (counterfoils or machine-numbered serial receipts issued by the entity)

- Original bills and payment receipts related to expenses incurred

- Any other necessary books required to provide a true and fair view of the entity’s financial transactions

- Books of account related to business undertakings under Section 11(4)

- Books of account for any other business carried out by the auditee

(b) Records Related to Projects and Institutions

- Details of all projects and institutions run by the entity, including their name, address, and objectives. [Rule 17AA(1)(d)(i)]

(c) Record of Income

- Comprehensive record of income earned during the previous year. [Rule 17AA(1)(d)(ii)]

(d) Application of Income

- Record of how income was applied in the previous year. [Rule 17AA(1)(d)(iii)]

- Record of income applied from previous years’ funds (prior to the current year). [Rule 17AA(1)(d)(iv)]

(e) Record of Corpus Contributions

- Details of voluntary contributions made with specific instructions that they shall form part of the corpus. [Rule 17AA(1)(d)(v)]

(f) Contributions for Religious Institutions' Renovation or Repairs

- Details of contributions received for renovation or repair of places of worship, such as temples, mosques, gurdwaras, churches, or any other places notified under Section 80G(2)(b) and treated as corpus donations. [Rule 17AA(1)(d)(vi)]

(g) Record of Loans and Borrowings

- Complete record of all loans and borrowings undertaken by the entity. [Rule 17AA(1)(d)(vii)]

(h) Record of Properties

- Documentation related to properties owned by the trust/institution. [Rule 17AA(1)(d)(viii)]

(i) Record of Specified Persons

- Details of transactions with specified persons as per tax regulations. [Rule 17AA(1)(d)(ix)]

(j) Other Relevant Documents

- Any other relevant records or documents necessary for compliance. [Rule 17AA(1)(d)(x)]

Conclusion

To ensure compliance with Rule 17AA, the trust or institution must maintain a comprehensive set of financial records, covering income, expenses, corpus contributions, projects, and properties. Auditors must verify that these records are kept as required and report any discrepancies in their audit observations.

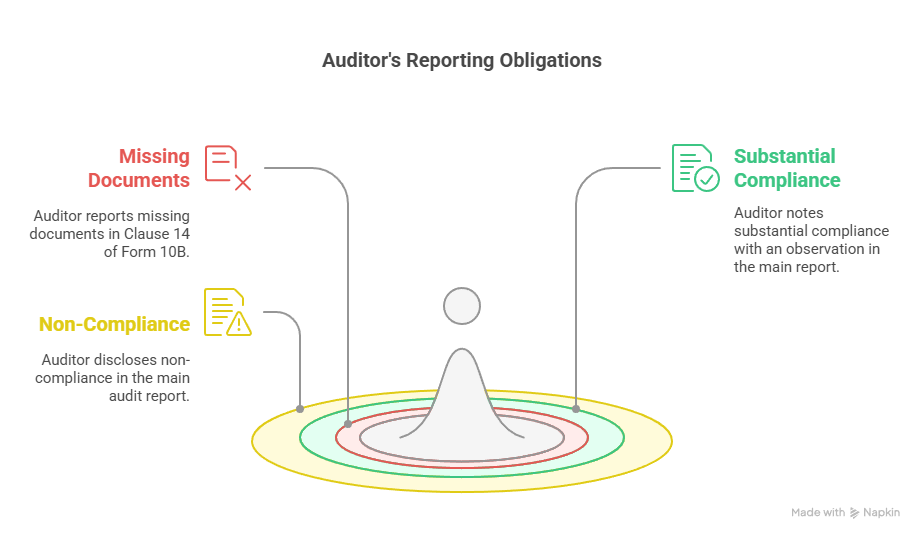

FAQ : Auditor's Obligation to Report Maintenance of Documents Under Rule 17AA

Yes, the auditor must report whether the auditee has maintained the specified documents under Rule 17AA, even if the books of account are properly kept.

- If, during the audit, it is found that the books of account are maintained but the specified documents required under Rule 17AA are missing, the auditor should report this in Clause 14 of Form 10B.

- If most of the required documents are available, the auditor may consider that compliance has been substantially met but should still include an audit observation in the main report.

Differences in Reporting Requirements

- Clause 14 of Form 10B requires a list of both books of account and specified documents.

- Clause 11 of Form 10BB requires the auditor to confirm whether the books of account and other documents are maintained as per Rule 17AA, including their form, manner, and location.

Thus, if the required documents are not properly maintained, the auditor should disclose this as an observation or qualification in the main audit report of Form 10B or 10BB.

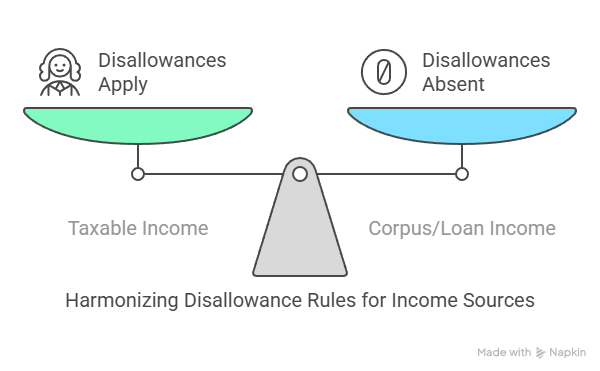

FAQ : Disallowance of Application of Income from Various Sources

Issue:

- Clause 31 of Form 10B and Clause 23 of Form 10BB require reporting of the application of income along with the amount to be disallowed under various sections.

- However, Clause 37 of Form 10B and Clause 27 of Form 10BB do not provide for such disallowances when income is applied from sources other than taxable income (e.g., corpus funds or loans).

Opinion:

- The same disallowances (such as cash payments above ₹10,000 or non-deduction of TDS) should apply to applications made from corpus or loans.

- This appears to be an omission in Form 10B and 10BB.

- The auditor should include a separate note in the audit report mentioning disallowances against applications from corpus or loans, even though the form does not explicitly require it.

FAQ : Application of Income for Acquiring Fixed Assets.

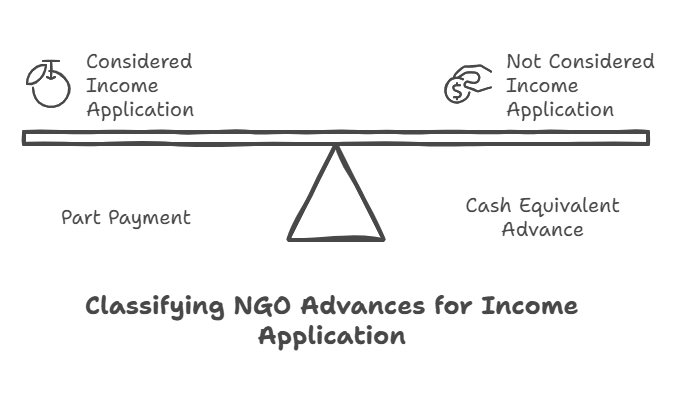

An NGO's advance payments towards fixed assets may be treated as an application of income, depending on its nature.

Classification of Advances:

Part Payment for Goods/Services – Considered an application if the advance is against a contract for goods or services.

Cash Equivalent Advances – Not an application if recoverable at the NGO’s discretion (similar to cash in hand).

Auditor’s Responsibility:

- Review contracts & documentation to ensure classification accuracy.

Differentiate between partial payments & advances—only part payments qualify as application of income.

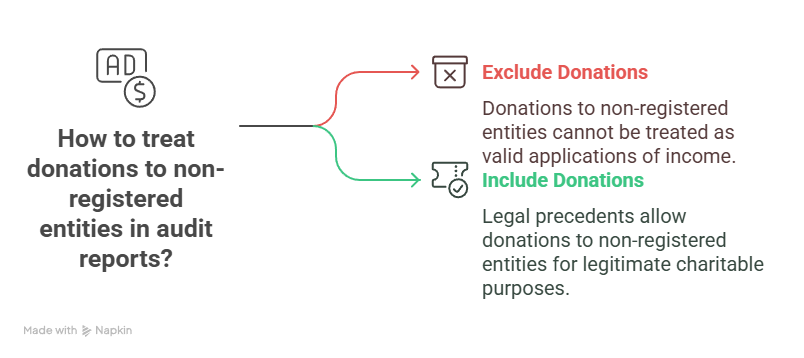

FAQ : Exclusion of Donations to Non-Registered Entities in Application Calculation

Key Considerations:

- Reporting Requirement

- Clause 23 of Form 10BB and Clause 31 of Form 10B require auditors to exclude donations made to entities not registered under:

- Section 10(23C)(iv), (v), (vi), (via) (approved funds, trusts, educational/medical institutions).

- Section 11 or 12 (registered trusts/institutions).

- Inter-charity grants must be excluded unless made to these registered or approved

- Legal Precedents Allowing Donations to Non-Registered Entities

- Maria Social Service Society [2018] (Karnataka HC):

- Foreign contribution to a non-12AA entity was not illegal.

- Dharmavana Arboretum (Hyderabad ITAT):

- Inter-charity donations to non-12AA societies were permitted if used for legitimate charitable purposes.

- Audit Reporting Approach

- If an NGO donates to an unregistered entity, it cannot be treated as a valid application of income in Form 10B/10BB.

A disclosure note should be added in the main audit report of Form 10B/10BB explaining the treatment of such grants.

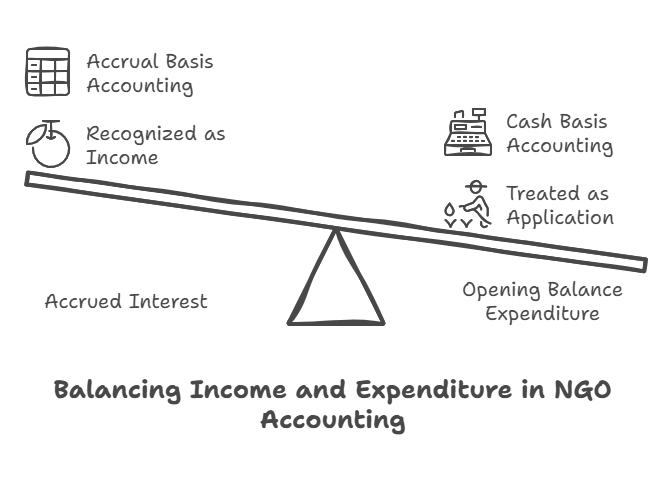

FAQ : Determining Income Application for an NGO with Accrued Interest and Opening Balance Expenditure

Key Points:

- Treatment of Accrued Interest and Expenditure

- The accrued interest of ₹11 lakhs should be recognized as income.

- The ₹10 lakhs spent from the opening bank balance should be treated as an application of income, irrespective of the source of funds.

- Requirement to File Form 9A

- If the NGO does not have sufficient cash balance, it may file Form 9A to claim a deferment of income application.

- However, if the application already exceeds 85% of income, filing Form 9A is not required.

- Cash vs. Accrual Basis of Accounting

- The NGO can adopt a cash basis of accounting, which is preferable to avoid TDS reconciliation issues in Form 26AS.

- The Finance Act, 2022 clarified that application of income is recognized only when actual payment is made, regardless of when the liability is incurred.

- Voluntary contributions should always be treated as income on a receipt basis.

- Interest income subject to TDS may be accounted for on an accrual basis.

- Cash Flow Matching Not Required

- The NGO does not need to match the income with the source of expenditure.

- If the NGO declares an income of ₹11 lakhs and spends ₹10 lakhs, it has already applied more than 85% and is not required to file Form 9A.

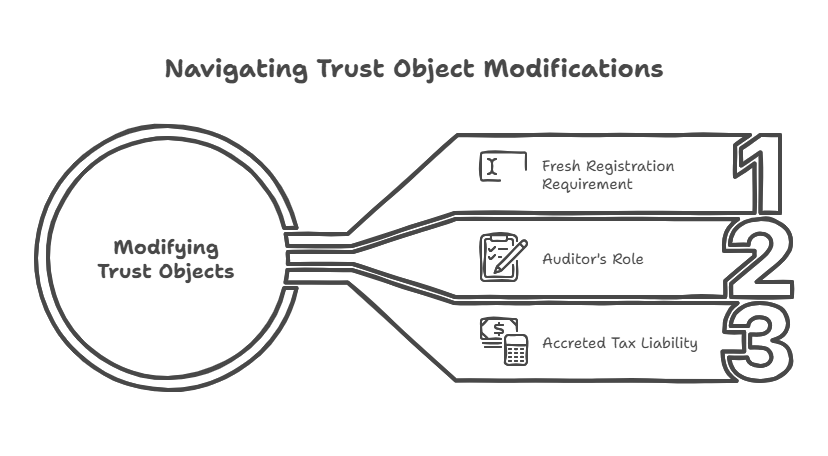

FAQ : Auditor's Reporting Obligation for Modification of Trust's Objects

Key Points:

- Reporting Requirement in Form 10B

- Clause 11: Auditor must report the objects of the institution.

- Clause 12: Auditor must verify if the trust or institution has modified its objects, and if so, whether they conform to the conditions of registration.

- Reporting Obligation: The date of modification must also be reported.

- Legal Considerations:

- If a trust expands its objectives (e.g., an educational institution adding an environmental protection clause), it may still be valid if both objects fall under section 2(15).

- Section 12AB(4) (Applicable from AY 2022-23): Any activity beyond the stated objectives of the trust is considered a specified violation and can lead to cancellation proceedings.

- Re-registration Requirement: Any major modification of objects must be approved through a fresh registration application.

- Non-Object Modifications:

- If modifications relate only to management, governance, or administration (and do not affect the charitable nature of the trust), they do not require re-registration.

- Auditor’s Due Diligence:

- The auditor should review:

- Original constitution documents (Trust Deed, MOA, etc.).

- Registration certificate granted by the Income Tax Department.

- Any changes that do not conform to the registration conditions must be reported in Form 10B.

FAQ : Implications of Modifying Trust's Objects Beyond Registration Conditions

Key Points:

- Fresh Registration Requirement:

- If a trust registered under Section 12AB modifies its objects in a way that does not conform to its registration, it must apply for fresh registration.

- The application must be filed within 30 days from the date of modification in the prescribed form and manner.

- Auditor’s Role in Form 10B (Clause 12):

- The auditor must report:

- Whether the trust has applied for re-registration.

- Application date and current status of the re-registration request.

- Accreted Tax Liability under Section 115TD:

- If the trust fails to apply for re-registration or its application is rejected, it becomes liable to pay accreted tax.

- Accreted tax is charged at the Maximum Marginal Rate (MMR), in addition to regular income tax.

- This tax is applicable when the trust’s assets are deemed to have been transferred out of the charitable framework due to non-compliance.

Conclusion

✅ Trusts must ensure that any object modification aligns with their registration conditions to avoid compliance issues.

✅ Failure to re-register in case of non-conforming modifications can lead to cancellation, accreted tax liability, and penalties.

✅ Auditors should carefully verify modifications and report them appropriately in Form 10B.

FAQ : Auditor's Reporting of Receipts Where TDS Has Been Deducted

Key Considerations for Reporting Under Clause 19 of Form 10B:

- Importance of TDS Reporting:

- TDS deduction on receipts directly impacts the classification of the trust’s activities as business or commercial.

- The auditor must examine whether the TDS deducted pertains to business activities under Sections 11(4) or 11(4A).

- Misclassified TDS Deductions:

- Some donors or organizations erroneously deduct TDS on grants, CSR contributions, or insurance reimbursements.

- Example: In medical institutions, insurance companies often deduct TDS when paying bills on behalf of patients.

- Such receipts are not business-related and should be reported under "Others" with remarks clarifying the misclassification.

- Sections Requiring Reporting in Clause 19:

- Section 194C – Contractor payments.

- Section 194J – Professional/technical services.

- Section 194H – Commission/brokerage.

- Section 194O – E-commerce transactions.

- Maintaining Separate Books for Business Income:

- If business-related receipts exist, the auditor must verify whether separate books of accounts are maintained as required under Section 11(4A).

- Business income is eligible for exemption under Section 11 only if it is incidental to the trust's objectives and separate books of accounts are maintained.

- Documents Required for Reporting:

- TDS certificates and Form 26AS.

- Ledgers of involved parties.

- Contracts and MOUs related to the transactions.

Conclusion:

✅ Business-related income must be reported under specific clauses in Form 10B to ensure transparency and compliance.

✅ Auditors should carefully examine TDS deductions to prevent misclassification of receipts as business income.

✅ Trusts must maintain separate books for business-related income to claim exemption under Section 11.

FAQ : Significance of Categorization Under Clause 19 of Form 10B

Categorization of Receipts on Which TDS Has Been Deducted

Clause 19 of Form 10B requires the auditor to classify receipts on which TDS has been deducted into the following categories:

- Trade, Commerce, or Business:

- Includes activities involving sale of goods or provision of services that generate income.

- Example: A charitable hospital selling medicines at a profit.

- Activity of Rendering Any Service in Relation to Trade, Commerce, or Business:

- Covers situations where services are rendered in connection with commercial activities.

- Example: A trust conducting paid training programs for corporations.

- Others:

- Includes receipts that do not fall under business or trade-related activities.

- Example: CSR grants, government project grants, or donations where TDS has been deducted inadvertently.

Why This Categorization Matters in Assessment?

✅ Impact on Tax Exemptions:

- Business-related income (categories 1 & 2) must comply with Section 11(4A), requiring separate books of accounts to claim exemption.

- Misclassification could lead to loss of exemption or increased scrutiny.

✅ Clarification of Non-Business Receipts:

- Many donors erroneously deduct TDS on grants, CSR contributions, or other charitable funds under Sections 194C or 194J.

- If misclassified under "Trade, Commerce, or Business," the trust may face unnecessary tax liabilities.

- The auditor should carefully report such cases under 'Others' with proper clarification to avoid misinterpretation.

✅ Avoiding Unnecessary Tax Liability:

- If a trust is seen as earning business income, the Assessing Officer may question its charitable status.

- Proper classification helps prevent tax demands under Section 115TD (exit tax for trusts losing registration).

Conclusion:

🔹 The auditor must carefully classify TDS-deducted receipts to ensure they align with the trust’s charitable objectives.

🔹 CSR or grant-based deductions should not be misclassified as business income, as this could affect tax exemptions.

🔹 A clear justification for 'Others' category receipts helps avoid scrutiny and tax disputes.

FAQ : Reporting of Business-Related Income in Annexure to Form 10B

Clauses Requiring Reporting of Business Income:

The following clauses in the Annexure to Form 10B require the reporting of business-related income:

- Clause 15 & Clause 16:

- Covers activities related to the Advancement of General Public Utility (GPU).

- If any activity is conducted in the nature of trade, commerce, or business, it must be reported as per the proviso to Section 2(15).

- Clause 17:

- Includes any business undertaking operated by the trust, as covered under Section 11(4).

- Clause 18:

- Relates to income from profits and gains of business, as defined under the seventh proviso to Section 10(23C) or Section 11(4A).

- Clause 19:

- Requires reporting of receipts where tax has been deducted at source (TDS) under the following sections:

- Section 194C: Payments to contractors.

- Section 194J: Professional or technical fees.

- Section 194H: Commission or brokerage.

- Section 194O: TDS on e-commerce transactions.

FAQ : Auditor's Reporting of Receipts Where TDS Has Been Deducted

Key Considerations for Reporting Under Clause 19 of Form 10B:

- Importance of TDS Reporting:

- TDS deduction on receipts directly impacts the classification of the trust’s activities as business or commercial.

- The auditor must examine whether the TDS deducted pertains to business activities under Sections 11(4) or 11(4A).

- Misclassified TDS Deductions:

- Some donors or organizations erroneously deduct TDS on grants, CSR contributions, or insurance reimbursements.

- Example: In medical institutions, insurance companies often deduct TDS when paying bills on behalf of patients.

- Such receipts are not business-related and should be reported under "Others" with remarks clarifying the misclassification.

- Sections Requiring Reporting in Clause 19:

- Section 194C – Contractor payments.

- Section 194J – Professional/technical services.

- Section 194H – Commission/brokerage.

- Section 194O – E-commerce transactions.

- Maintaining Separate Books for Business Income:

- If business-related receipts exist, the auditor must verify whether separate books of accounts are maintained as required under Section 11(4A).

- Business income is eligible for exemption under Section 11 only if it is incidental to the trust's objectives and separate books of accounts are maintained.

- Documents Required for Reporting:

- TDS certificates and Form 26AS.

- Ledgers of involved parties.

- Contracts and MOUs related to the transactions.

Conclusion:

✅ Business-related income must be reported under specific clauses in Form 10B to ensure transparency and compliance.

✅ Auditors should carefully examine TDS deductions to prevent misclassification of receipts as business income.

✅ Trusts must maintain separate books for business-related income to claim exemption under Section 11.

FAQ : Significance of Categorization Under Clause 19 of Form 10B

Categorization of Receipts on Which TDS Has Been Deducted

Clause 19 of Form 10B requires the auditor to classify receipts on which TDS has been deducted into the following categories:

- Trade, Commerce, or Business:

- Includes activities involving sale of goods or provision of services that generate income.

- Example: A charitable hospital selling medicines at a profit.

- Activity of Rendering Any Service in Relation to Trade, Commerce, or Business:

- Covers situations where services are rendered in connection with commercial activities.

- Example: A trust conducting paid training programs for corporations.

- Others:

- Includes receipts that do not fall under business or trade-related activities.

- Example: CSR grants, government project grants, or donations where TDS has been deducted inadvertently.

Why This Categorization Matters in Assessment?

✅ Impact on Tax Exemptions:

- Business-related income (categories 1 & 2) must comply with Section 11(4A), requiring separate books of accounts to claim exemption.

- Misclassification could lead to loss of exemption or increased scrutiny.

✅ Clarification of Non-Business Receipts:

- Many donors erroneously deduct TDS on grants, CSR contributions, or other charitable funds under Sections 194C or 194J.

- If misclassified under "Trade, Commerce, or Business," the trust may face unnecessary tax liabilities.

- The auditor should carefully report such cases under 'Others' with proper clarification to avoid misinterpretation.

✅ Avoiding Unnecessary Tax Liability:

- If a trust is seen as earning business income, the Assessing Officer may question its charitable status.

- Proper classification helps prevent tax demands under Section 115TD (exit tax for trusts losing registration).

Conclusion:

🔹 The auditor must carefully classify TDS-deducted receipts to ensure they align with the trust’s charitable objectives.

🔹 CSR or grant-based deductions should not be misclassified as business income, as this could affect tax exemptions.

🔹 A clear justification for 'Others' category receipts helps avoid scrutiny and tax disputes.

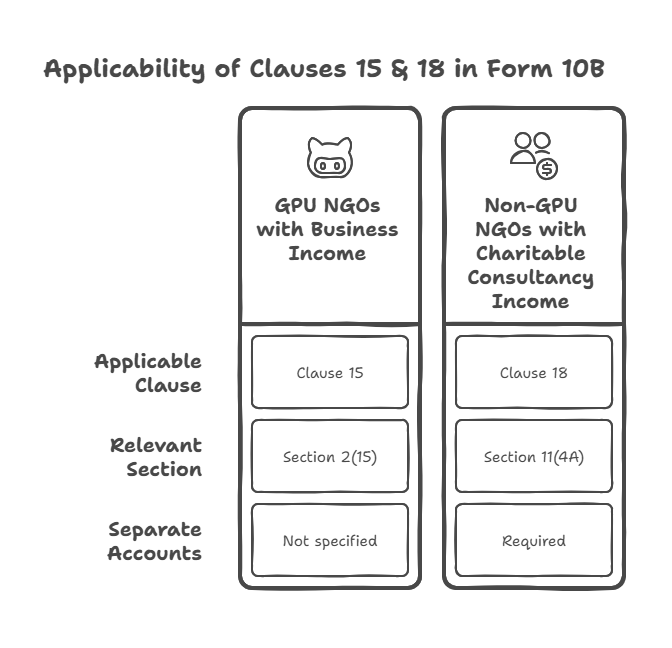

FAQ : Reporting Consultancy Income in Form 10B – Clause 15

Applicability of Clause 15 in Form 10B

Clause 15 of Form 10B applies only to NGOs under the "General Public Utility" (GPU) category that engage in commercial or business activities. It is meant to ensure compliance with the proviso to Section 2(15), which limits the extent of commercial activities permissible for a GPU organization.

🔹 If an NGO or a division of an NGO falls under GPU and generates business income, it must report such receipts under Clause 15.

🔹 If the NGO does not belong to the GPU category, Clause 15 does not apply, and such income must be reported under Clause 18, per Section 11(4A).What About Consultancy Income from Charitable Purposes?

✅ If an NGO not categorized under GPU earns consultancy income related to its charitable objectives, such income may qualify as "business incidental to charitable purposes."

✅ Exemption under Section 11(4A) is available only if separate books of account are maintained for such income-generating activities.

✅ Since this does not fall under GPU, Clause 15 does not apply—instead, the income must be reported under Clause 18.Key Takeaways:

✔ Clause 15 applies only to GPU organizations with commercial income.

✔ Consultancy income from charitable activities (other than GPU) should be reported under Clause 18.

✔ Maintaining separate books of account is necessary to claim exemption under Section 11(4A).

✔ Incorrect reporting may lead to scrutiny or loss of exemption benefits.

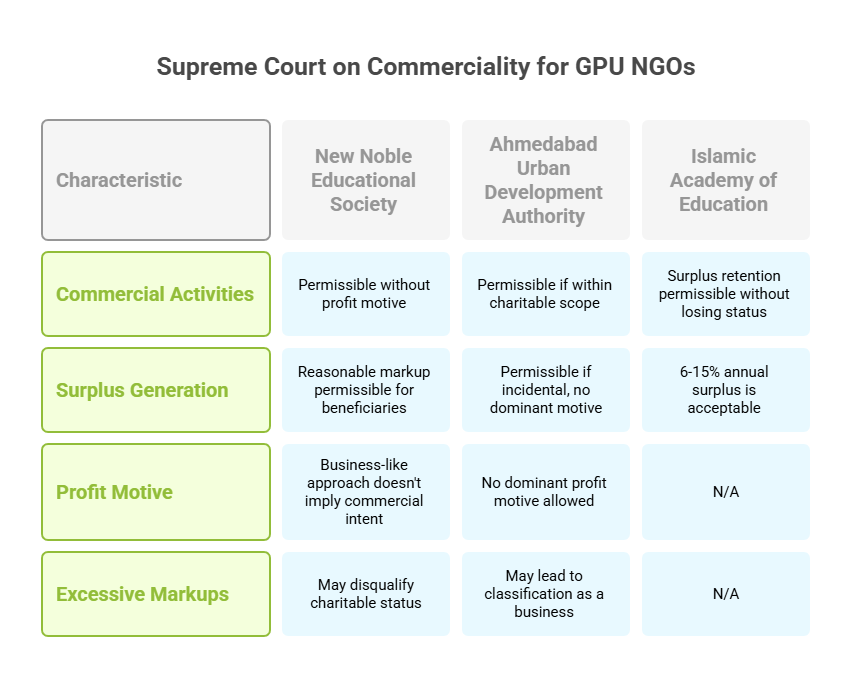

FAQ : Reasonable Markup for Determining Commerciality in GPU Category NGOs

Supreme Court’s View on Charitable Activities with a Commercial Approach

The Supreme Court of India has provided key rulings regarding the classification of activities undertaken by General Public Utility (GPU) NGOs and whether they amount to business:

📌 New Noble Educational Society v. Chief CIT [2022] 143 taxmann.com 276

✔ Charitable institutions can conduct activities on commercial principles without a profit motive.

✔ Services can be provided at cost or with a reasonable markup for beneficiaries.

✔ The presence of a business-like approach does not automatically imply commercial intent.📌 Ahmedabad Urban Development Authority [2022] 143 taxmann.com 278

✔ Surplus generation is permissible if it occurs within the scope of charitable activities.

✔ A GPU organization can generate profits, provided:

- The profit is incidental to its main charitable purpose.

- There is no dominant profit motive.

📌 Islamic Academy of Education v. State of Karnataka (2003)

✔ Educational institutions can retain a surplus of 6% to 15% annually without affecting their charitable character.What is Considered a "Reasonable Markup"?

✔ Cost-to-cost pricing or minimal markup is ideal for charitable organizations.

✔ A reasonable surplus (6%-15%) is generally acceptable, based on Supreme Court rulings.

✔ Excessive profit-making or a primary profit motive could disqualify an NGO from charitable status under Section 2(15).Key Takeaways:

✅ GPU NGOs can charge fees as long as they are not profit-driven.

✅ Surplus of up to 6%-15% is reasonable based on past legal precedents.

✅ Profit-making is acceptable only if incidental to charitable objectives.

✅ Excessive markups may lead to classification as a business, impacting tax exemptions.

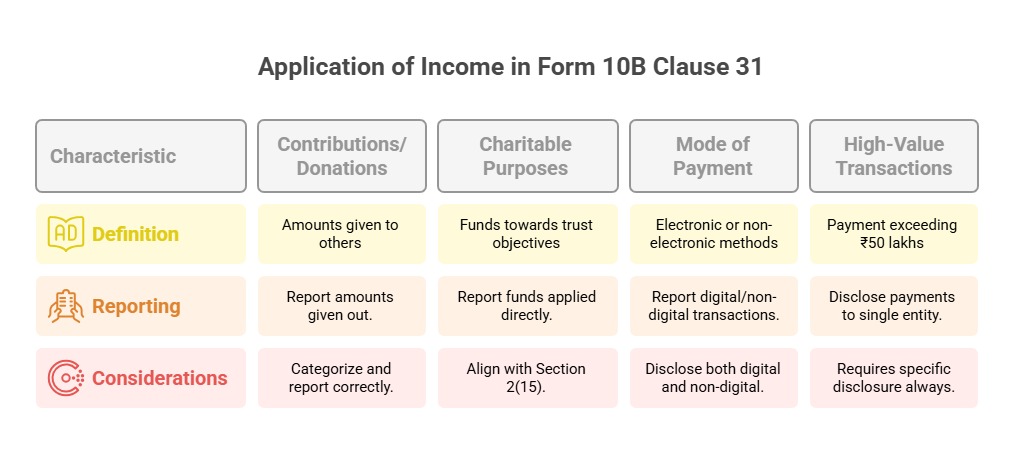

FAQ : Categorization of Application of Income in Clause 31 of Form 10B

Clause 31 of Form 10B requires detailed reporting of the application of income under various heads. The reporting must be done based on the nature of application and the mode of payment (electronic or non-electronic).

Key Categories of Application in Clause 31:

1️⃣ Contributions or Donations

- Amounts given to any other person or entity during the previous year.

2️⃣ Application Based on Charitable Purposes (Section 2(15))

- Funds applied directly towards the objectives of the trust.

- Any other application that does not fit into a specific section 2(15) category but is still charitable.

3️⃣ Mode of Payment

- Electronic payments (NEFT, RTGS, online transfers, etc.).

- Non-electronic methods (cash, cheque, etc.).

4️⃣ High-Value Transactions

- Any payment exceeding ₹50 lakhs to a single person/entity during the financial year.

Key Considerations:

✔ All applications of income must be categorized and reported correctly.

✔ Large payments (₹50 lakh+) require specific disclosure.

✔ Charitable expenditure should align with Section 2(15) definitions.

✔ Both digital and non-digital transactions must be disclosed.

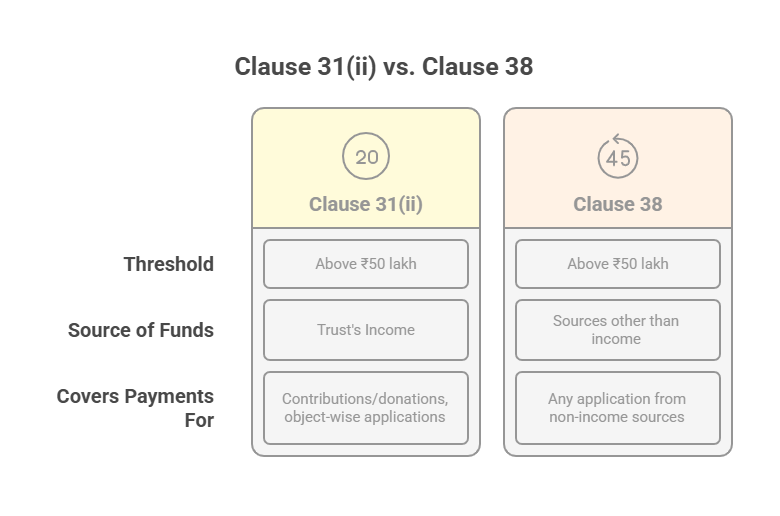

FAQ : Comparison Between Clause 31(ii) and Clause 38 of Form 10B

Both Clause 31(ii) and Clause 38 require disclosure of payments exceeding ₹50 lakh in a financial year, but they differ in the source of funds used for such payments.

1️⃣ Clause 31(ii) – Application Out of Income

- Requires disclosure of payments above ₹50 lakh made from the trust’s income during the financial year.

- Covers payments for:

- Contributions or donations to any person/entity.

- Object-wise applications of funds for charitable purposes.

2️⃣ Clause 38 – Application from Other Sources

- Requires disclosure of payments above ₹50 lakh made from sources other than income (e.g., corpus donations, borrowings, or other external sources).

- Covers payments for:

- Any application made from non-income sources (e.g., reserves, loans, endowments).

Key Difference:

✔ Clause 31(ii) → Reports payments above ₹50 lakh from income.

✔ Clause 38 → Reports payments above ₹50 lakh from non-income sources.

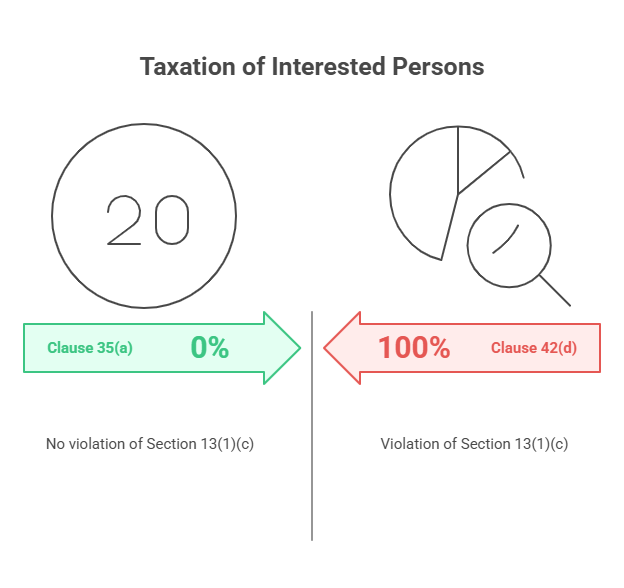

FAQ : Comparison Between Clause 35(a) and Clause 42(d) of Form 10B

Both clauses involve transactions with interested persons, but they focus on different aspects of taxation and compliance.

1️⃣ Clause 35(a) – Income Chargeable Under Section 12(2)

- Applies to medical or educational institutions operated by a trust.

- Requires reporting of income deemed taxable when services are provided to "interested persons" free of cost or at concessional rates.

- This income is taxed under Section 164(2) but does not result in a violation under Section 13(1)(c).

2️⃣ Clause 42(d) – Services Provided to Specified Persons

- Requires disclosure of whether the trust has provided services to any specified person without adequate remuneration or compensation.

- This is considered a violation of Section 13(1)(c) and results in taxation under Section 115BBI (higher tax rate).

Key Difference:

✔ Clause 35(a) → Reports income under Section 12(2) (deemed income for services to interested persons, but not a violation).

✔ Clause 42(d) → Reports services to specified persons without adequate compensation, leading to a Section 13(1)(c) violation and taxation under Section 115BBI.

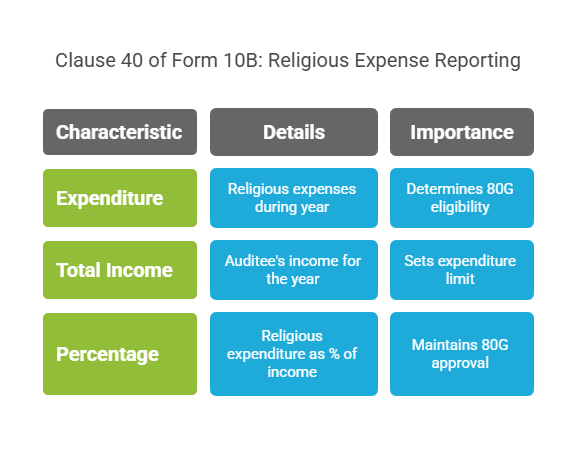

FAQ : Significance of Clause 40 in Form 10B Regarding Religious Expenses

Clause 40 is specifically applicable to institutions that have received approval under Section 80G(5). It requires reporting of religious expenditures to ensure compliance with the eligibility conditions for 80G approval.

Details Required Under Clause 40:

1️⃣ Expenditure of a religious nature during the previous year.

2️⃣ Total income of the auditee for the year.

3️⃣ Percentage of religious expenditure in relation to total income.Why is this Important?

- For approval under Section 80G, the institution must serve a charitable purpose and not be primarily religious in nature.

- However, if religious expenditure does not exceed 5% of total income, the institution remains eligible for 80G benefits.

Key Takeaway:

✔ Clause 40 ensures that religious expenses remain within the permissible limit of 5% for institutions seeking 80G approval.

FAQ : Disclosure of Cash Payments Exceeding ₹2 Lakh Under Clause 47

Does a Hospital Registered Under Section 12AB Need to Report Cash Payments Over ₹2 Lakh?

Yes. Clause 47 of Form 10B requires reporting of any cash receipts that exceed the threshold set by Section 269ST.

Key Provisions of Section 269ST:

🚫 A person cannot receive ₹2,00,000 or more in cash:

✅ From one person in a single day.

✅ In a single transaction.

✅ In transactions related to a specific event or occasion.💡 Violation of Section 269ST results in penalties under Section 271DA.

Key Takeaway:

✔ If a hospital receives cash payments exceeding ₹2 lakh from a single patient, it must be disclosed under Clause 47.

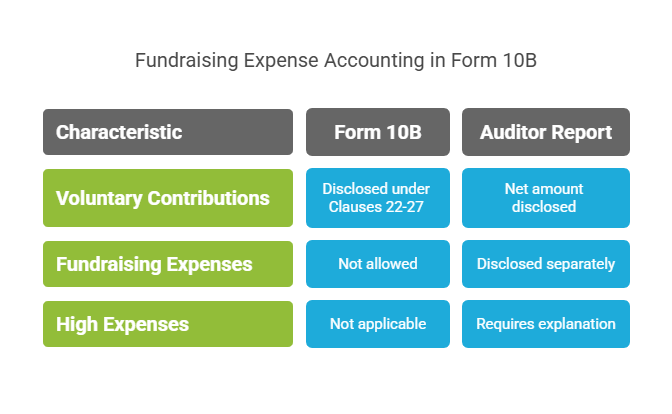

FAQ : Accounting for Fundraising Expenses in Voluntary Contributions

How Should Fundraising Expenses Be Reported in Form 10B?

- Clauses 22 to 26 require the disclosure of Voluntary Contributions, which are then aggregated under Clause 27.

- The source of reporting these contributions is the Statement of Donations (Form 10BD).

How to Account for Fundraising Expenses?

🚫 Form 10B does not allow reporting net voluntary contributions (after deducting fundraising costs).

✅ Instead, the auditor should disclose the net amount (after deducting expenses) in their report.

✅ If fundraising expenses are unusually high or claimed as part of charitable expenses, the auditor must exercise judgment and provide an explanation with financial figures.Key Takeaway:

✔ Fundraising expenses should be separately disclosed, and net voluntary contributions should be reported in the audit observations.

FAQ : Accounting for Fundraising Expenses in Voluntary Contributions

How Should Fundraising Expenses Be Reported in Form 10B?

- Clauses 22 to 26 require the disclosure of Voluntary Contributions, which are then aggregated under Clause 27.

- The source of reporting these contributions is the Statement of Donations (Form 10BD).

How to Account for Fundraising Expenses?

🚫 Form 10B does not allow reporting net voluntary contributions (after deducting fundraising costs).

✅ Instead, the auditor should disclose the net amount (after deducting expenses) in their report.

✅ If fundraising expenses are unusually high or claimed as part of charitable expenses, the auditor must exercise judgment and provide an explanation with financial figures.Key Takeaway:

✔v Fundraising expenses should be separately disclosed, and net voluntary contributions should be reported in the audit observations.

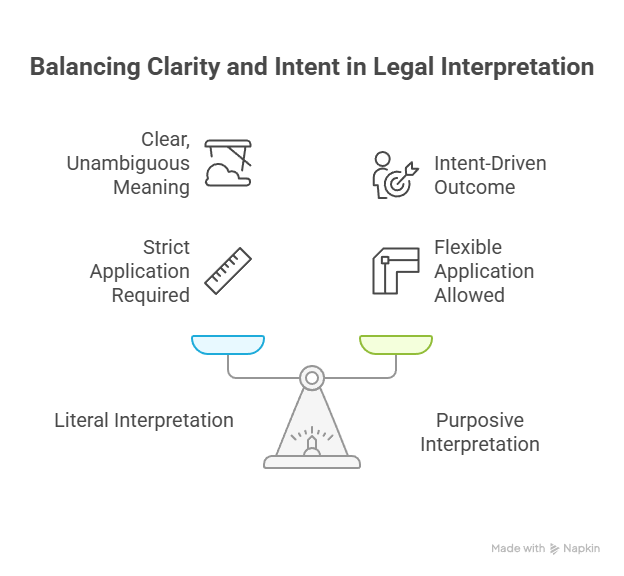

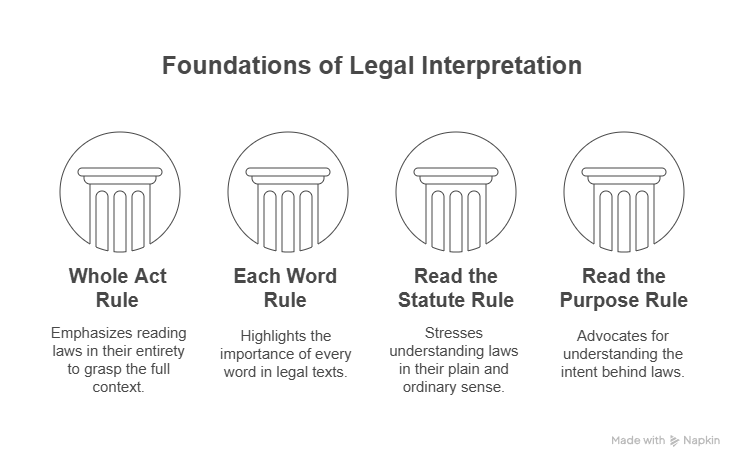

FAQ: What are the Ground Rules for Reading the Law?

The fundamental principles for understanding any law are:

- The Whole Act Rule

You wouldn’t understand the full message of a letter by reading only a part of it. The same applies when reading a law. Each provision of the Act must be read in connection with the others. Every section is crafted with care and is interlinked with the rest of the statute.

As observed in Canada Sugar Refining Co. Ltd. (1898) A.C. 735, Lord Davey said:

“Every clause of the statute is to be construed with reference to the context and other clauses of the Act so as to make a consistent enactment of the whole statute.”

- The Each Word Rule

In casual conversations, we might overlook specific words. But in legal texts, every word matters. Each word is chosen deliberately, with a purpose. Ignoring even a single word can distort the meaning of the law.

This is based on the Latin maxim: “Ut res magis valeat quam pereat”, which means:

“It is better to validate something than to render it meaningless.”

In Manchester Ship Canal Co. (1904) 2 Ch. 352, Lord Farwell said:

“Unless the words are completely meaningless, the court must try to give them some interpretation, rather than ignore them.”

- The Read the Statute Rule

As famously stated: "Read the statute! Read the statute! Read the statute!"

This rule emphasizes that if the language of the statute is clear and unambiguous, then it should be understood in its plain and ordinary sense—without adding or assuming anything.

In the Sussex Peerage Case (1884) 8 ER 1034, Lord Tindal C.J. stated:

“If the words of the statute are clear and precise, then the meaning must be taken as it is, in its natural sense.”

This is known as the Literal Rule of Interpretation. Don't jump to other aids or interpretations unless the language is unclear.

- The Read the Purpose Rule

Understanding the purpose behind a law is crucial. Reading a law without knowing why it was made is like walking through a maze without a map.

Before interpreting any provision, one should ask:

What is the objective behind this law?A purely mechanical reading, without understanding its purpose, can lead to absurd results.

In Director of Enforcement v. Deepak Mahajan (1994) 3 SCC 430, the Supreme Court remarked:

“Applying the law mechanically, without understanding its object and purpose, would make the law meaningless.”

So, always interpret the statute keeping its spirit and intent in mind.

FAQ: What Are the Primary Rules of Interpretation?

While these classifications don't make one rule superior to the others, they help us better understand how laws are read and applied.

- Literal Interpretation (Plain Meaning Rule)

Under this rule, a statute is interpreted by giving its words their ordinary, natural meaning. If reading the law literally gives a clear and unambiguous meaning, that meaning must be accepted—even if it seems harsh or illogical.

📌 Example:

In Shriram v. State of Bombay (AIR 1961 SC 674), the law required a magistrate to take evidence from produced witnesses. The Supreme Court clarified that "produced" and "cited" are different. The magistrate was only responsible for those actually brought before the court, not all names listed.📌 Example:

In Rajgopalachari v. Corporation of Madras (AIR 1964 SC 1172), pension was taxed as income (Entry 82, List I) and not as a tax on employment (Entry 60, List II), because the literal reading led to that interpretation.📌 Key Point:

In Britannia Industries Ltd. v. CIT (2005) 278 ITR 546 (SC), the Court stated that judges must not "read into" the law; if something is missing, only the legislature can correct it. Courts cannot insert what's not written.📌 Quote from SC (Union of India v. Dharmendra Textiles, 2008):

"Courts interpret the law; they don't write it. If something is missing from the law, it's for the legislature—not the courts—to fix."

📌 Tax Laws Reminder:

In Raja Jagdambika Pratap Narain Singh v. CBDT (1975), the Court reminded that equity (fairness) and tax laws are strangers. Tax laws are to be read as they are, not based on logic, fairness, or morality.

- Purposive Interpretation (Golden Rule)

This method looks at the intent or purpose behind a law. If a literal reading leads to an absurd or unjust outcome, the judge may depart from the plain words to fulfill the law's true purpose.

📌 Example:

In Lee v. Knapp (1967), a driver stopped briefly after an accident and left. The law required him to "stop", but the Court said the purpose was to allow time for inquiries, so a quick halt wasn’t enough.

- Harmonious Interpretation

Sometimes, two parts of the same law may seem to conflict. The goal is to read them in a way that gives meaning to both, without making one provision useless.

📌 Example:

In Raj Krishna Bose v. Binod Kanungo (AIR 1954 SC 202), the Court balanced two sections of the Representation of the People Act. One allowed a government servant to nominate a candidate; the other barred them from election assistance. The Court ruled that nomination wasn’t the same as campaigning, harmonizing the two provisions.

- Strict and Liberal Interpretation

This rule comes into play only when the law is unclear.

- Strict Interpretation: Used in penal, criminal, or tax laws. Anything not clearly mentioned is considered excluded.

- Liberal Interpretation: Used in social, labour, or welfare laws. If something reasonably fits the law’s purpose, it’s treated as included—even if not explicitly written.

📌 Example:

In Shree Sajjan Mills v. CIT (1985) 156 ITR 585 (SC), even though tax laws are generally read strictly, a reasonable interpretation can still apply to fulfill the law’s purpose.📌 Note:

In CIT v. Sorkar Builders (2015) 375 ITR 392 (SC), the Court emphasized that interpretation must avoid absurd or unjust results, and that exceptions to the "assessment year law applies" rule are allowed when clearly provided.

- Mischief Rule (Heydon’s Rule)

This rule asks: What was the problem (mischief) the law intended to solve? Then, the law should be interpreted in a way that prevents that mischief and helps achieve the law’s objective.

This rule comes from Heydon’s Case (76 ER 637), where the court suggested asking:

- What was the law before the Act?

- What problem did the earlier law fail to address?

- What solution did the new law bring?

- Why was this solution chosen?

📌 Example:

In Smith v. Hughes (1960), prostitutes soliciting from windows/balconies argued they weren’t "in the street." But the Court said the purpose of the Street Offences Act was to keep streets clean from solicitation. Hence, they were held to be in violation of the Act—even though literally, they were not "in" the street.

FAQ : When is an audit required for charitable trusts?

Charitable trusts must specific conditions to qualify for exemptions under Sections 11 and 12, including the mandatory audit of accounts under Section 12A(1)(b). Similarly, institutions approved under Section 10(23C) must have their accounts audited as per its tenth proviso.

An audit is required if the total income of the trust or institution, before claiming exemptions under Section 11, 12, or 10(23C), exceeds the basic exemption limit of ₹2,50,000. However, if the total income remains at or below this threshold, an audit is not mandatory.

FAQ : Is an audit necessary if a trust’s total income is ₹1.50 lakh, but its total application is ₹5.00 lakh?

No, an audit is not required in this case. The audit requirement applies only when the total income, before claiming exemptions under Section 11, 12, or 10(23C), exceeds ₹2,50,000. The amount spent or applied during the year does not determine the necessity of an audit.

FAQ: Which institutions under Section 10(23C) must submit an audit report in Form 10B/10BB?

Institutions approved by the Principal CIT or CIT under Section 10(23C) are required to file an audit report in Form 10B/10BB if they fall into any of the following categories:

(a) Funds or institutions established for charitable purposes as per Section 10(23C)(iv).

(b) Trusts or institutions dedicated entirely to public religious or charitable purposes under Section 10(23C)(v).

(c) Universities or educational institutions operating solely for educational purposes and not for profit under Section 10(23C)(vi).

(d) Hospitals or similar institutions providing medical care, rehabilitation, or treatment for individuals suffering from illnesses or mental disabilities, operating exclusively for philanthropic purposes and not for profit under Section 10(23C)(via).

FAQ : Do non-approved institutions under Section 10(23C) need to file an audit report in Form 10B/10BB?

Institutions that fall under the non-approval category of Section 10(23C) are eligible for tax exemption on their entire income with minimal compliance requirements. These entities are not subject to the audit report filing requirement. Their only obligation under the Income Tax Act is to submit their income tax return using Form ITR-7.

FAQ : Do organizations registered under Section 12AB and those approved under Section 10(23C) now follow the same audit report format?

Previously, two distinct audit report formats were used: Form 10B for institutions registered under Section 12AB and Form 10BB for those approved under Section 10(23C).

However, the revised Forms 10B and 10BB now apply to both categories. The selection of the appropriate form depends on specific conditions, such as whether the institution's total income exceeds ₹5 crores, whether it has received foreign contributions, or if it has utilized funds outside India.

It is crucial to note that while both Section 12A-registered trusts and Section 10(23C)-approved institutions must use these updated forms, certain clauses in these forms do not apply to institutions under Section 10(23C). Therefore, auditors must carefully assess whether the entity is registered under Section 12AB or approved under Section 10(23C) before completing Form 10B/10BB. Despite recent amendments, some key differences remain between these two categories.

Key Provisions Exclusive to Section 12AB Registered Trusts (Not Applicable to Section 10(23C) Institutions):

- Modification of Objects: Section 10(23C) institutions do not require re-registration upon modification of their objectives.

- Application of Income Outside India: Unlike Section 11(1)(c), there are no restrictions on applying income outside India.

- Public Benefit Requirement: Section 10(23C) institutions do not face exemption withdrawal or approval cancellation if income is not utilized for public benefit, unlike Section 13(1)(a).

- Restrictions on Religious Community or Caste: Section 10(23C) institutions do not lose exemption if income benefits a specific religious community or caste, unlike Section 13(1)(b).

- Deemed Application of Income: There is no provision for deemed application of income through Form 9A.

- Capital Gains Exemption: Section 10(23C) institutions do not enjoy capital gains exemption under Section 11(1A).

- Business Held Under Trust: Unlike Section 11(4), there is no provision for business income being held under trust.

These differences highlight that while the audit report formats have been aligned, variations in compliance requirements still exist between Section 12AB-registered trusts and Section 10(23C)-approved institutions.

FAQ : What is the definition of "Foreign Contribution" for determining the applicability of Form 10B/10BB submission?

The term "foreign contribution" holds the same meaning as defined under clause (h) of Section 2(1) of the Foreign Contribution (Regulation) Act, 2010 (FCRA, 2010). This includes not only direct foreign contributions but also any income derived from such contributions, such as interest income from investments made using foreign funds and income generated from assets acquired using foreign contributions.

FAQ : If a trust-operated educational institution collects ₹4 crores in total income before availing exemptions under Sections 11, 12, or 10(23C), but does not utilize any of it outside India, should fees collected from foreign students be considered a "foreign contribution" for determining the audit report format?

No, fees collected from foreign students or any payments received for services rendered do not qualify as foreign contributions.

As per Explanation 3 to Section 2(1)(h) of FCRA, 2010, any amount received from a foreign source as fees charged by an educational institution in India or as contributions from a foreign source’s agent specifically toward such fees is excluded from the definition of "foreign contribution."

Therefore, even if the trust collects fees from foreign students during the relevant financial year, this will not be classified as receiving a foreign contribution for audit reporting purposes.

FAQ : Does a trust receive "foreign contributions" when it obtains funds from foreign sources in exchange for goods or services provided as part of its regular business activities?

No, it does not.

As per Explanation 3 to Section 2(1)(h) of FCRA, 2010, any payment received from a foreign source in exchange for goods or services rendered as part of regular business, trade, or commercial activities—whether conducted within India or internationally—does not qualify as a foreign contribution. Additionally, any amount received from a foreign source’s agent to cover such fees or costs is also excluded from the definition of foreign contributions.

FAQ : Is the fee paid by foreign delegates or participants for attending conferences, seminars, etc., classified as a foreign contribution?

No, it is not.

As clarified in FAQ No. 12 of the FAQs on FCRA (available at https://fcraonline.nic.in), fees paid by foreign delegates or participants to attend conferences or seminars are not considered foreign contributions. These amounts are specifically intended to cover the event's expenses and are therefore excluded from the scope of foreign contributions under FCRA, 2010.

FAQ : If a trust registered under FCRA has not received any foreign contributions during the current financial year but has earned income from the sale of assets acquired using foreign contributions, does this income qualify as a foreign contribution? Which audit report form should be used?

Yes, income generated from the sale of assets originally acquired using foreign contributions is considered a foreign contribution.

As per Item 2 of Form FC-4 under FCRA, 2010, foreign contributions for the year include not only direct receipts but also interest earned on foreign contributions and any income derived from assets created using foreign funds—such as proceeds from their sale.

In such cases, the trust must submit an audit report in Form 10B to comply with the reporting requirements.

FAQ : If an NGO’s FCRA registration has been revoked or its renewal denied, but it continues to earn interest on foreign assets, which form should be used for the audit report?

Even after an NGO's FCRA registration has been cancelled, any interest earned on its foreign assets remains classified as a foreign contribution under FCRA, 2010.

Thus, the NGO must file an audit report using Form 10B.

FAQ : If an NGO sends its staff abroad for training, should it file Form 10B or Form 10BB?

Sending NGO employees abroad for training purposes does not automatically classify as an application of income outside India under Section 11(1)(c).

If all other conditions for Form 10BB are met, the NGO should file Form 10BB instead of Form 10B.

FAQ : What qualifies as "application of income outside India" for filing an audit report in Form 10B?

According to Section 11(1)(c) of the Income Tax Act, income spent on activities outside India does not qualify for exemption unless the following conditions are met:

(a) The charitable organization was established before April 1, 1952, or is engaged in the promotion of international welfare in which India has an interest.

(b) The CBDT (Central Board of Direct Taxes) has granted approval through a general or special order for such activities.

Organizations seeking approval for carrying out charitable activities abroad must submit their applications to Member (IT), CBDT, Department of Revenue, Ministry of Finance, North Block, New Delhi.

If the above conditions are not fulfilled, income spent on activities outside India will be taxable under Section 115BBI.

FAQ : If an NGO sends its staff abroad for training, should it file Form 10B or Form 10BB?

Sending NGO employees abroad for training purposes does not automatically classify as an application of income outside India under Section 11(1)(c).

If all other conditions for Form 10BB are met, the NGO should file Form 10BB instead of Form 10B.

FAQ : Are corpus donations and capital gains included in calculating the ₹5 crore threshold for filing Form 10B?

Yes.

The obligation to file Form 10B arises when the total income of a charitable institution—calculated without considering exemptions under Sections 11 and 12—exceeds ₹5 crore.

Since corpus donations and capital gains receive exemptions under Section 11, these amounts must be included when determining whether the ₹5 crore threshold has been exceeded.

FAQ: Should agricultural income, exempt under Section 10(1), be included when calculating the ₹5 crore threshold for filing Form 10B?

No.

As per Section 11(7) of the Income Tax Act, agricultural income is not subject to the conditions of exemption under Sections 11 and 12.

Therefore, agricultural income does not need to be added when calculating the ₹5 crore limit for determining the applicability of Form 10B.

FAQ : Who is eligible to audit the accounts of a trust or institution?

The audit must be conducted by an accountant as defined under the Explanation to Section 288(2) of the Income Tax Act.

According to this provision, a Chartered Accountant (CA) holding a valid Certificate of Practice is eligible to undertake the audit. However, the CA must not be disqualified under clauses (a) and (b) of the Explanation to Section 288(2).

FAQ : Is there a limit on the number of audit assignments a Chartered Accountant can undertake for trusts and institutions under Section 12A or Section 10(23C)?

No, there is no such limit.

The Council Guidelines of 2008 under Chapter IX specify a limit of 60 tax audits under Section 44AB of the Income Tax Act. However, this limit applies only to tax audits under Section 44AB and does not apply to audits of trusts and institutions under Section 12A or Section 10(23C).

Therefore, a Chartered Accountant can undertake multiple audits of trusts and institutions without any upper limit.

FAQ : Can an auditor comment on the application of funds solely based on the Income and Expenditure Account in Form 10B and Form 10BB?

The audit reports in Form 10B and Form 10BB require the auditor to express an opinion on whether the Income and Expenditure Account (or Profit and Loss Account) gives a true and fair view of the income, application of funds, profit, or loss, considering any observations or qualifications.

Understanding the Concept of "Application" of Income:

- The term “Application” in this context is not the same as "Expenditure."

- Section 11(1) of the Income Tax Act states that income derived from property held under trust for charitable and religious purposes or receipts from voluntary contributions is exempt if applied for charitable purposes in India.

- The Finance Act, 2022 introduced an Explanation to Section 11(7), which states that application of income is recognized only on a payment basis, meaning expenses are considered "applied" only in the year they are actually paid, not when they are incurred.

- Both revenue and capital expenditures for charitable purposes are considered as an application of income.

Challenges in Determining Application Solely from the Income & Expenditure Account:

- The Income and Expenditure Account is traditionally prepared using accrual accounting, whereas the Income Tax Act requires application to be determined on a payment basis.

- Application from corpus, loans, and borrowings is now restricted.

- Past deficits cannot be set off against the current year's income when computing the 85% application requirement.